As venture capital slows down, early-stage entrepreneurs and those looking to do something on their own are likely to turn wary. But anybody who studies entrepreneurship will likely find that passion and patience have inevitably trumped money in determining the success of a venture. Money is often a catalyst. But there are also some who think venture funding is a bane, that ultimately, success is more about you and the problem you are trying to solve.

As venture capital slows down, early-stage entrepreneurs and those looking to do something on their own are likely to turn wary. But anybody who studies entrepreneurship will likely find that passion and patience have inevitably trumped money in determining the success of a venture. Money is often a catalyst. But there are also some who think venture funding is a bane, that ultimately, success is more about you and the problem you are trying to solve.

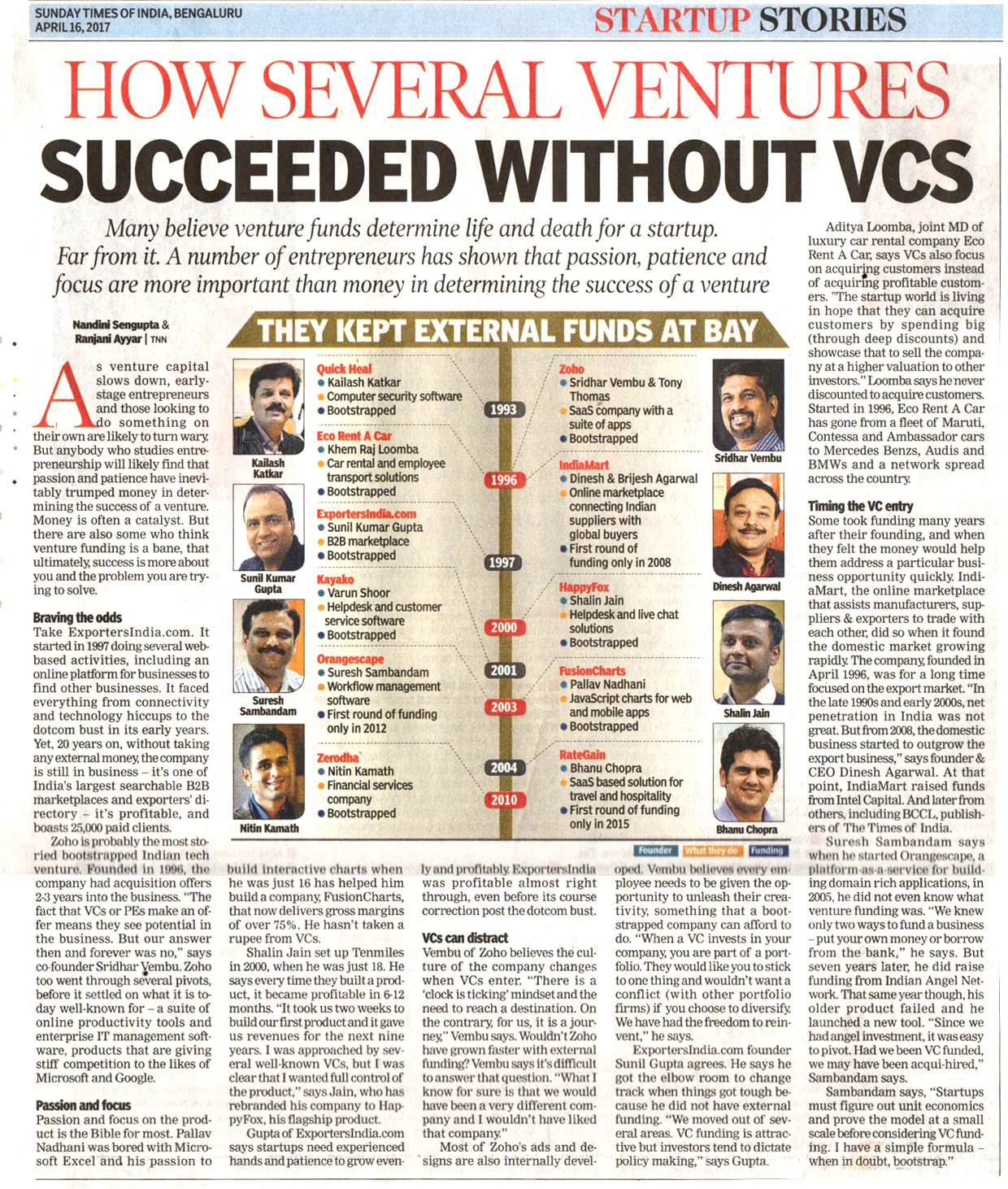

Timing the VC entry

Some took funding many years after their founding, and when they felt the money would help them address a particular business opportunity quickly. IndiaMart, the online marketplace that assists manufacturers, suppliers & exporters to trade with each other, did so when it found the domestic market growing rapidly. The company, founded in April 1996, was for a long time focused on the export market. “In the late 1990s and early 2000s, net penetration in India was not great. But from 2008, the domestic business started to outgrow the export business,” says founder & CEO Dinesh Agarwal. At that point, IndiaMart raised funds from Intel Capital. It later raised money also from Amadeus Capital, Quona Capital, Westbridge Capital, and BCCL, publishers of The Times of India.