IndiaMART InterMESH Limited (NSE:INDIAMART), is not the largest company out there, but it led the NSEI gainers with a relatively large price hike in the past couple of weeks. With many analysts covering the stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. But what if there is still an opportunity to buy? Let’s examine IndiaMART InterMESH’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

Is IndiaMART InterMESH Still Cheap?

IndiaMART InterMESH appears to be expensive according to my price multiple model, which makes a comparison between the company’s price-to-earnings ratio and the industry average. In this instance, I’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. I find that IndiaMART InterMESH’s ratio of 56.68x is above its peer average of 23.2x, which suggests the stock is trading at a higher price compared to the Trade Distributors industry. Another thing to keep in mind is that IndiaMART InterMESH’s share price is quite stable relative to the rest of the market, as indicated by its low beta. This means that if you believe the current share price should move towards the levels of its industry peers over time, a low beta could suggest it is not likely to reach that level anytime soon, and once it’s there, it may be hard for it to fall back down into an attractive buying range again.

What kind of growth will IndiaMART InterMESH generate?

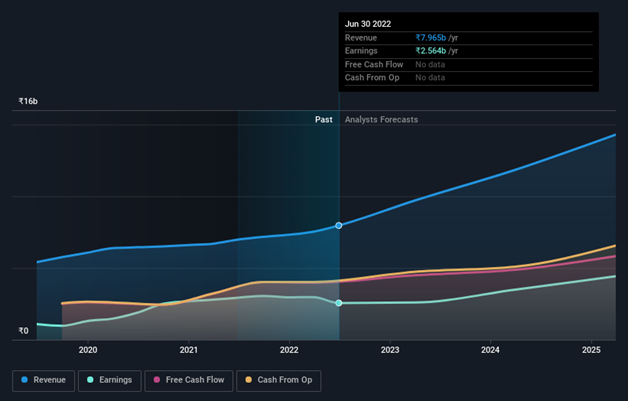

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. IndiaMART InterMESH’s earnings over the next few years are expected to increase by 80%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What This Means For You

Are you a shareholder? It seems like the market has well and truly priced in INDIAMART’s positive outlook, with shares trading above industry price multiples. At this current price, shareholders may be asking a different question – should I sell? If you believe INDIAMART should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. But before you make this decision, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping tabs on INDIAMART for some time, now may not be the best time to enter into the stock. The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. However, the positive outlook is encouraging for INDIAMART, which means it’s worth diving deeper into other factors in order to take advantage of the next price drop.