- IndiaMART InterMESH is country’s largest online market place has already begun to reign over the market. Among 11 IPOs introduced this year,

- IndiaMART was the only one that reported highest gains of about 34.05 percent this year and about 45 percent returns this month.

- The stock has jumped 78 percent in 2.5 months since its issue price.

India’s largest online market place IndiaMART InterMESH has already begun to reign over the market. Among 11 IPOs in 2019, IndiaMART reported highest gains of about 34.05 percent so far this year. The stock price rose about 45 percent in September.

IndiaMART InterMESH made stock market debut on July 4 at the issue price of Rs 973 and rose 78 percent in two and a half month to Rs 1,736 per share today on the NSE. Moreover, IndiaMART shares hit all-time highs in the last nine sessions straight, rising nearly 20 percent.

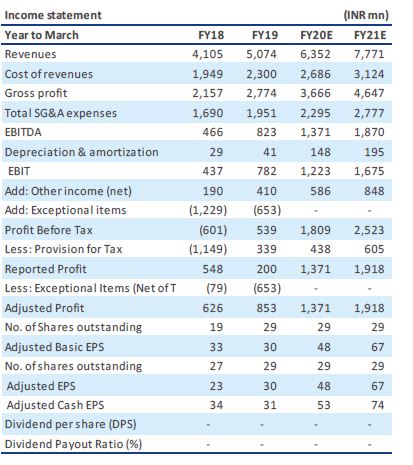

In terms of earnings performance, the company continues to present strong grip over its financials. During the June 2019 quarter, the company’s revenue from operations rose 29 percent year-over-year to Rs 144 crore.

Earnings before interest, tax, depreciation and amortization jumped 192 percent YoY to Rs 38 crore. As of June 31, 2019, the company’s cash and investments stands at Rs 739 crore.

On the liquidity front, the company’s stands at a comfortable place. Average volume since the listing is at 2.5 lakh shares. So, on the basis of high stock price, the average turnover stands at Rs 35 crore.

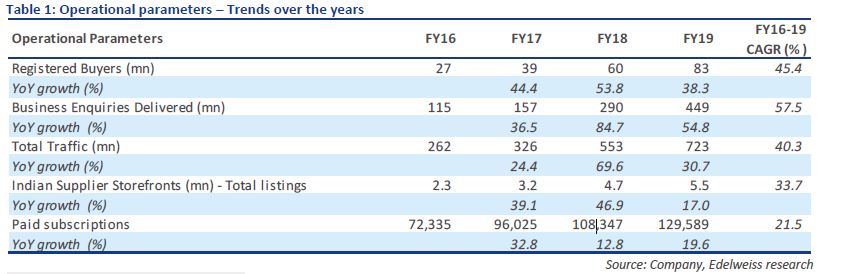

Edelweiss in a report said, “We are seeing a strong network effect at play. Growth in suppliers is luring more buyers and driving business enquiries, which in turn is attracting more sellers too. We believe IndiaMART is on the cusp of strong profit growth momentum led by revenue growth and high operating leverage.”

The brokerage initiated coverage on IndiaMART with a ‘BUY’ and ‘Sector Outperformer’ rating. The target price is at Rs 1,900 based on 33x Q3FY21E EPS. Expect the company to generate an earnings CAGR of 50 percent over FY19–21 driven by strong revenue growth and high operating leverage, said the brokerage in the September 12 report.

As of promoter holding, the shareholding structure, as on 30 June 2019, involves 53 percent promoter and promoter group holding, with 23 percent of foreign ownership and 7 percent owned by mutual funds, banks and alternative investment funds. Post-IPO, Intel Capital, Amadeus IV DPF and Accion Frontier Inclusion hold an aggregate of 12.5 percent of the company.

Founded in 1999, the company has 60 percent market share of the online B2B classified space in India, and caters about 82.7 million buyers, 5.55 million suppliers and 60.73 million products and services. The company has 2,915 employees located across 72 offices in the country.