Domestic IPOs may provide a good exit route for venture capital investors in B2B, SaaS and enterprise technology companies

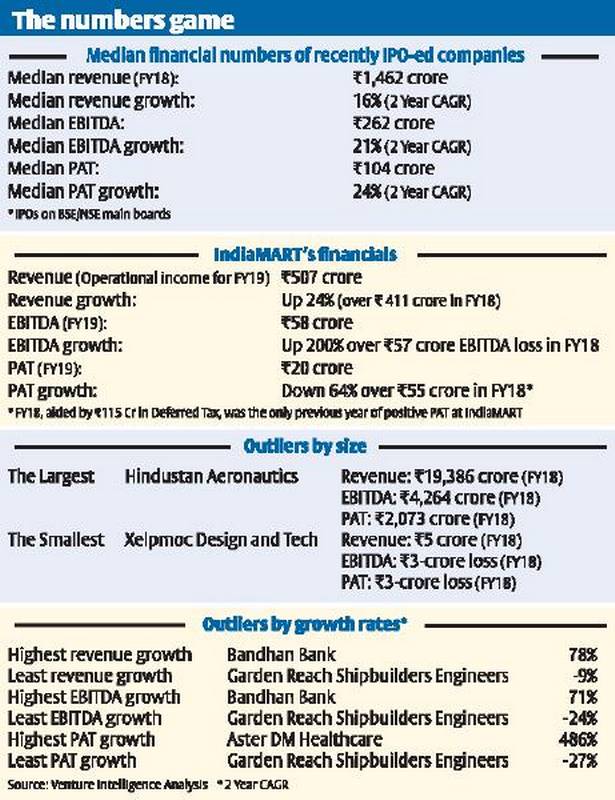

Venture capitalists and others associated with the start-up ecosystem in the country were thrilled when the initial public offering of IndiaMART InterMESH Ltd, which operates Indiamart.com, an online B2B marketplace for business products and services, listed on the stock exchanges at a premium to the offer price and closed the day nearly 34 per cent over the offer price of ₹973 a share.

Many tweeted in glee, appreciating Dinesh Agarwal, Founder and CEO, IndiaMART, for the doggedness with which he persisted with the business. Vijay Shekhar Sharma, Founder, Paytm, tweeted “such an outstanding IPO! Super cheer for Dinesh Agarwal and whole IndiaMART team. What an awesome outcome.”

Rehan Yar Khan, Managing Partner, Orios Venture Partners, said the public issue was oversubscribed 36 times showed the hunger for a quality tech stock. “Is expected that from 2021, there will be a regular stream of tech IPOs in India. Potentially exciting times ahead from a tech market perspective,” he said in anemail message. Orios was not an investor in the company and said it was sharing this view from a tech market perspective.

According to an analysis done by Venture Intelligence, which tracks venture capital and private equity investments, IndiaMART’s IPO provided exits to three VC/PE investors – Intel Capital, which first invested in the company in November 2008; Quona Capital and Amadeus Capital, both of which invested in 2016-17.

Exit route

Based on its analysis, Venture Intelligence feels domestic IPOs may provide a good exit route for VC investors in B2B, SaaS and enterprise technology companies, especially ones that achieve reasonable scale and demonstrate two-three years of profitability. “However, it is not clear whether the local market will develop an appetite for loss-making consumer-oriented start-ups,” Venture Intelligence said.

According to it, IndiaMART is the first online marketplace company to go public in India; there are four pure play internet companies that have listed in the country – InfoEdge, which went public in 2006; JustDial and Matrimony.com, both of which were backed by VCs; and, Infibeam.com, a pure-play e-commerce company.

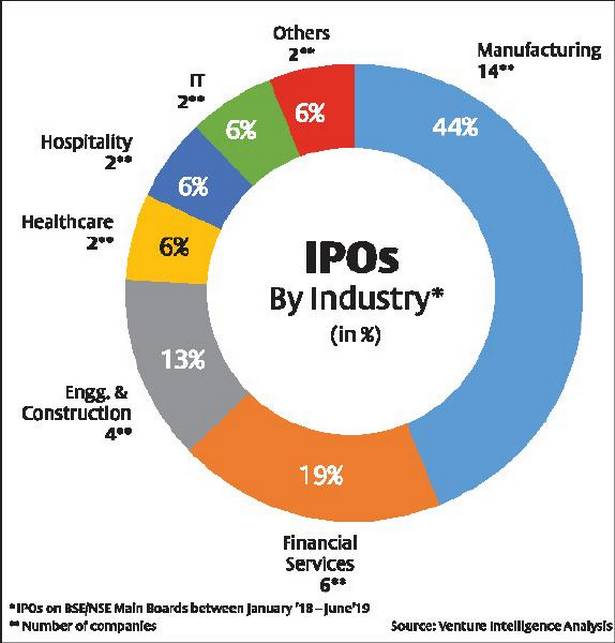

Venture Intelligence analysed 32 companies that went public between January 2018 and June 2019. Only two IPOs in the last 18 months were from the IT industry – Newgen Software Technologies, an enterprise software firm, which provided healthy exits to late-stage investors Ascent Capital, Chiratae Ventures and Sapphire Ventures; and, IT services company Xelp, which raised ₹23 crore. Two VC-backed enterprise technology companies – E2E Networks (in which Blume Ventures was an investor) and SoftTech Engineers (backed by Rajasthan Venture Capital Fund) – went public, raising less than ₹25 crore on the SME exchanges in 2018.