Business Standard,

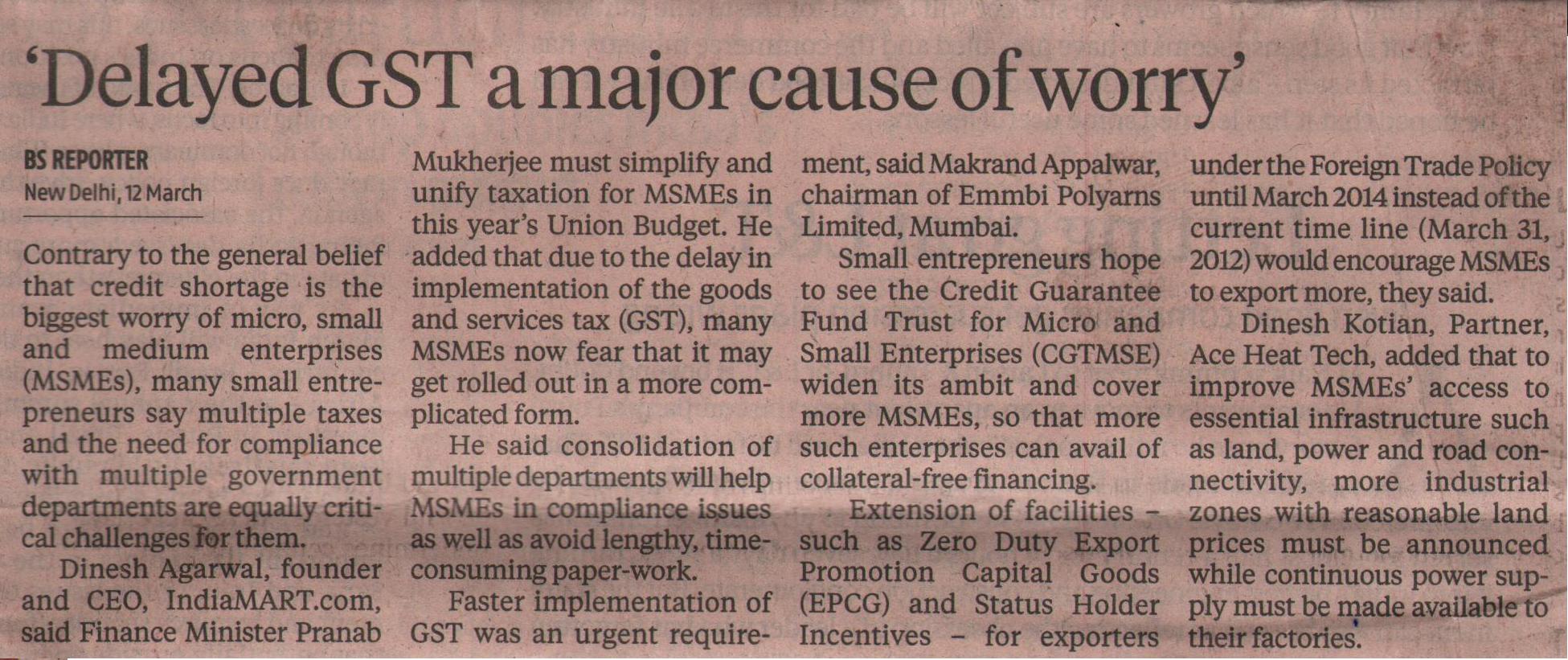

Contrary to the general belief that credit shortage is the biggest worry of micro, small and medium enterprises (MSMEs), many small entrepreneurs say multiple taxes and the need for compliance with multiple government departments are equally critical challenges for them.

Dinesh Agarwal, founder and CEO, IndiaMART.com, said Finance Minister Pranab Mukherjee must simplify and unify taxation for MSMEs in this year’s Union Budget. He added that due to the delay in implementation of the goods and services tax (GST), many MSMEs now fear that it may get rolled out in a more complicated form.

He said consolidation of multiple departments will help MSMEs in compliance issues as well as avoid lengthy, time-consuming paper-work.

Faster implementation of GST was an urgent requirement, said Makrand Appalwar, chairman of Emmbi Polyarns Limited, Mumbai.

Small entrepreneurs hope to see the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) widen its ambit and cover more MSMEs, so that more such enterprises can avail of collateral-free financing.

Extension of facilities – such as Zero Duty Export Promotion Capital Goods (EPCG) and Status Holder Incentives – for exporters under the Foreign Trade Policy until March 2014 instead of the current time line (March 31, 2012) would encourage MSMEs to export more, they said.

Dinesh Kotian, Partner, Ace Heat Tech, added that to improve MSMEs’ access to essential infrastructure such as land, power and road connectivity, more industrial zones with reasonable land prices must be announced while continuous power supply must be made available to their factories.

Read more at www.business-standard.com