Noida-based B2B marketplace IndiaMART has invested in over a dozen startups since it went public. Here’s a deep dive at what the company looks for in a startup.

In February 2021, when IndiaMART InterMESH Ltd, an online business-to-business (B2B) marketplace, raised about Rs 1,070 crore from qualified institutional buyers, it had a clear agenda — expansion.

However, inorganic expansion isn’t easy for IndiaMart, which facilitates buy-sell transactions spanning over 97,000 different categories. After all, it needed to look for businesses with a matching synergy that would benefit its network of over 143 million buyers and 7 million+ store fronts.

Between February and November 2021, “We met about over 200-300 companies, explored various sectors,” Dinesh Agarwal, Founder and Chief Executive Officer of IndiaMART, tells YourStory.

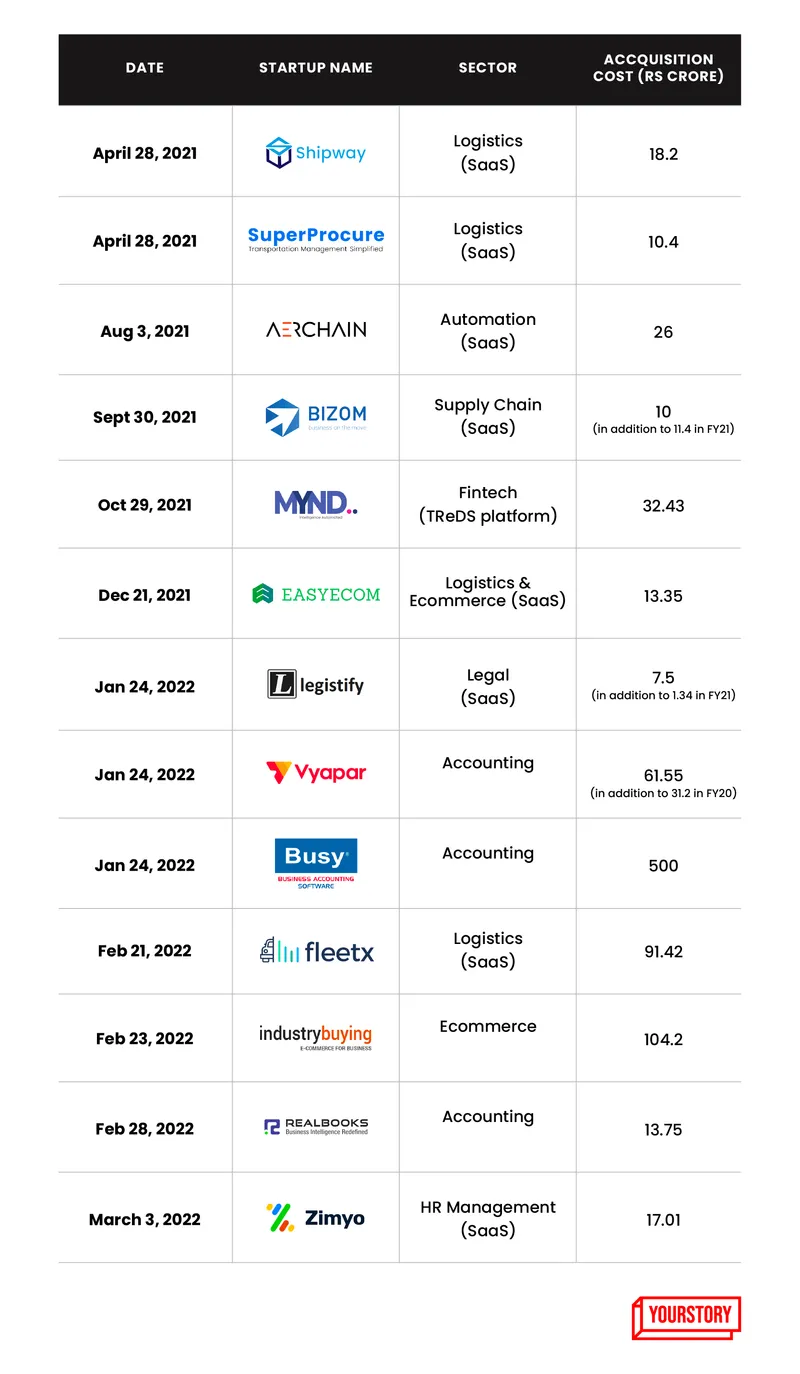

While the Noida-based company had made a few acquisitions earlier, the spree really began last year. Since April 2021, it has spent over Rs 905 crore across 13 deals.

In fact, in the last five months — since October 2021 — it has bought stakes in nine tech startups including Zimyo, Realbooks, IMPL, Fleetx Technologies, Busy Infotech, Simply Vyapar, Legistify, EasyEcom, and M1Xchange.

These investments — across accounting, logistics, etc — are expected to further the business development of IndiaMART’s customers, says Dinesh.

The aim was simple — aid the digital adoption by businesses across India.

Across India Inc, the COVID-19 pandemic has been a catalyst of sorts when it comes to digital adoption and adaption, and small and medium enterprises have learnt the value of digital in a harsher way, says an investment banker, who has been working closely with startups that have listing plans in the near future, on the condition of anonymity.

And IndiaMART hopes to capitalise on this rising need. “There are three segments—micro and small, medium, and large. For each of them, there is a different offering that is needed. One size doesn’t fit all,” says Dinesh.

For example, in accounting, micro and small businesses can benefit from Vyapaar’s offerings, medium-sized ones can avail Busy’s software, while large businesses that need a multi-location facility can use Realbooks. Then, HR and payroll management is taken care of by Ziymo, invoicing by M1Xchange.

While most of these are minority investments, IndiaMART still has a lot to gain– and to offer.

What’s in it for the startups?

Punit Gupta, Founder, and CEO of e-commerce solutions provider EasyEcom, told YourStory in a previous interaction in January 2022, “More than the capital, it is the partnership we are excited about, where we are able to collaborate with them (IndiaMART) to propel our journey.

“The scale is what fascinates me about IndiaMart,” he added.

IndiaMART invested Rs 13.35 crore in EasyEcom for a 26.01 percent stake in December 2021. The Bengaluru-based startup offers omnichannel solutions for e-commerce businesses and sellers, with 150 ready-to-use integrations for stock management, warehousing, and order management.

Entrepreneurs like Punit are excited about the potential information and network exchange with a company that has been in the sector since 1996.

Punit added, “The partnership is very valuable for us because along with the money, they also bring in the know-how to work with small and medium enterprises in India, which nobody knows better than IndiaMART.”

An added bonus is the entrepreneurial experience and expertise brought to the table by Dinesh, who is mentoring these startups on product, distribution strategy, and building teams.

“The first couple of quarters go into understanding their customer persona and pain points better,” he adds.

He will also guide them in monthly or quarterly review meetings, with his experience and understanding of why some products fail or succeed, what sales strategies worked in the past and what didn’t.

IndiaMART also has built a strong subscription business, with 95 percent of its revenue coming from subscriptions—and can help sell subscriptions in the B2B segment.

How would IndiaMART gain?

A large part of the investment it raised in February 2021 has already been used. With the remaining amount, “We will see if we can make one or two more investments,” Dinesh says.

For the company, these are both financial and strategic investments.

“First and foremost, every minority investment must have a good return financially over 5-10 years,” he adds.

There is a clear vision in IndiaMART’s acquisitions. While return on investments may fructify in the long term, the immediate advantage is the stickiness it can offer its customer base that is the target audience of the startups it is investing in, the unnamed i-banker opines.

IndiaMART has a large market opportunity, with more than 63 million registered medium and small size enterprises(MSMEs) and more than 12 million GST registered businesses in the country, as of August 2021.

These investments, in turn, fall in line with IndiaMART’s long-term vision of providing a holistic ecosystem for all business needs. This involves a collaborative and integrated ecosystem for finance and accounting, payroll, attendance and HR management modules, logistic companies among others.

“We tried to see if there are possible synergies that can emerge over the next 3-5 years, so that we can go deeper and also get higher sales and higher market penetration for IndiaMART in the digital accounting ecosystem,” Dinesh adds.

The broader vision involves offering a bundled service for sellers — inventory management, order management, accounting, invoicing, receivables management, tax compliance, distribution management as basic functions on the company’s store.

“At the same time, we want to empower them to have a better store at IndiaMART with better SKUs (stock keeping unit),” says Dinesh.

The larger startup ecosystem is constantly innovating and the startups in IndiaMART’s portfolio could be its armoury of sorts to future-proof its business, as well as define stronger moat, the i-banker adds.

COVID-19

Some of these acquisitions such as Shipway, EasyEcom, Fleetx are due to the emerging opportunities in the growing direct-to-consumer (D2C) and e-commerce segments. For context, according to IBEF, India’s e-commerce market is expected to grow to $111.40 billion by 2025, up from $46.2 billion in 2020.

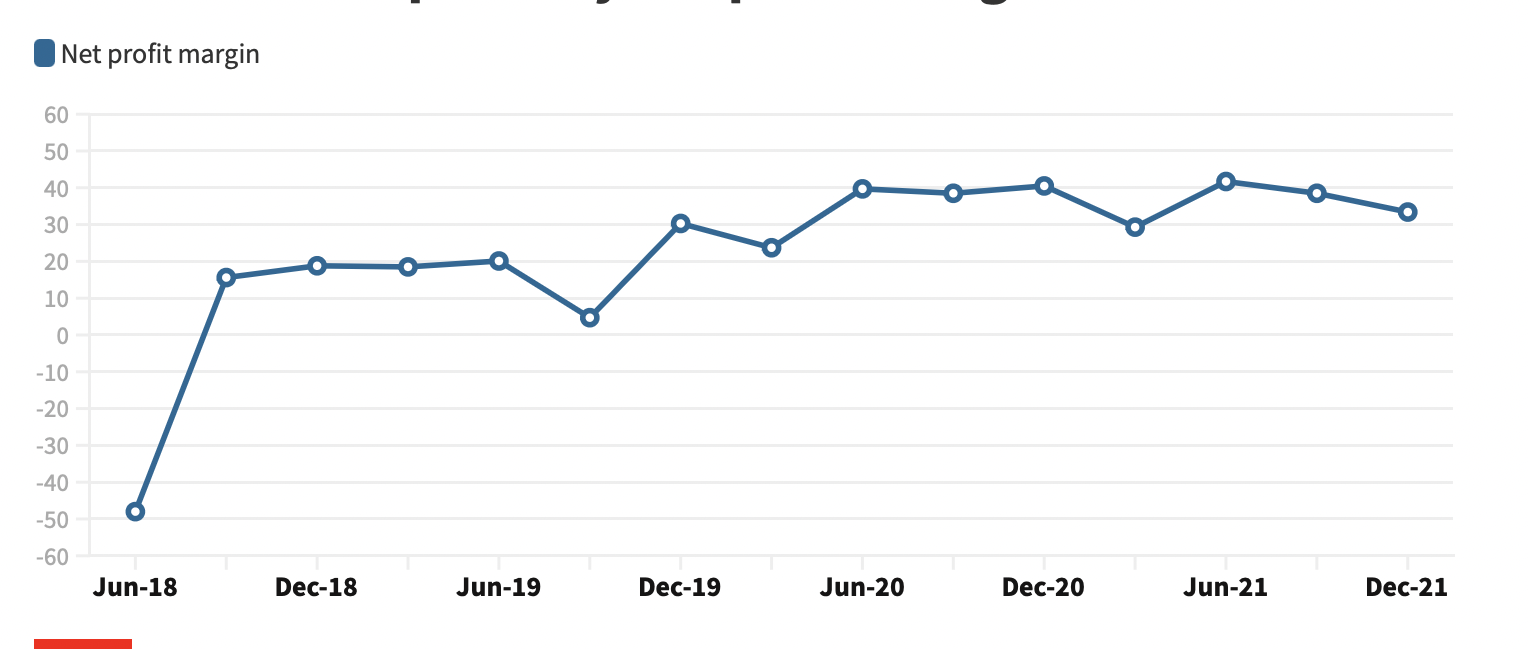

IndiaMART’s quarterly net profit margin since June 2018

When the pandemic hit in March 2020, “our entire focus was on cost optimization and home migration” Dinesh recalls.

And it has worked.

In FY 2021, IndiaMART reported revenue from operations of Rs 669.6 crore, growing 5 percent on a yearly basis.

IndiaMART’s quarterly revenue and profits since June 2018

It was in December 2020- January 2021 that the company started looking at inorganic growth opportunities.

By this time, MSMEs were already adopting technology use, forced by months of lockdown earlier, and online GST payments mandates. Already, their next generation of owners is technology savvy.

The company’s management is keen on using Software-as-a-Service (SaaS) solutions, which could benefit these small businesses and help them grow. It is aiming to improve engagement through fintech, SaaS, and vertical commerce.

Added to that, Dinesh says, “MSMEs trust IndiaMART for the products that we have been facilitating for them over the years. So, when we go to them with another offering, they are more likely to trust IndiaMART, with the product and distribution system.”

Key categories

Accounting

Of all its investments, accounting software company Busy Infotech was a significant one, with IndiaMART paying about Rs 500 crore for fully acquiring it.

The New-Delhi-based company, with a presence across India, incorporated in 1997, is profitable. In FY21, Busy Infotech reported revenue of Rs 42.4 crore and a profit after tax of Rs 11 crore — an enviable net profit margin of nearly 26 percent.

“Lakhs of Indian businesses rely on Busy Accounting Software for their accounting needs, and the value proposition fits in well with IndiaMART’s long term objective of making doing business easy for Indian businesses,” Dinesh said at the time of the acquisition.

Earlier this month, IndiaMART bought a minority stake in cloud-based accounting software Realbooks, which enables businesses to create customized invoices, attach files to vouchers, and manage their inventory.

IndiaMART extended its holding in mobile-based self-accounting software Simply Vyapaar in January 2022 to 27 percent, putting in another Rs 61.55 crore in Series B round, added to the Rs 31.2 crore it had invested in September 2019, for a 26 percent stake.

Logistics and transportation

With Shipway, SuperProcure, and Fleetx, IndiaMART is offering SaaS solutions for logistics, an industry that can benefit more from the Internet of Things-enabled applications and data.

“Supply Chain Visibility (SCV) is a critical yet underserved problem faced by Indian businesses and fleet owners,” Dinesh says.

It invested Rs 91.42 crore for a 16.53 percent stake in Fleetx, which provides freight and fleet management software for fleet operators and businesses to digitize their logistics operations. It provides them visibility of vehicles and related IoT-based analytics services.

IndiaMART invested another Rs 18.2 crore in Shipway for a 26 percent stake, and Rs 10.4 crore in SuperPorcure for a 25 percent stake.

SuperProcure is a SaaS-based platform, which helps digitize the entire freight sourcing by finding the best possible rates through a transparent bidding and auction structure, while Shipway develops SaaS-based solutions that allow small businesses to automate their shipping operations.

B2B commerce

With the B2B commerce space heating up with unicorns like Udaan, Moglix among others, IndiaMART is also strengthening its e-commerce play.

It invested Rs 104.2 crore in Japanese e-commerce player IB MonotaRO (IMPL) and Rs 13.35 crore in EasyEcom.

While it may have been tempting for IndiaMART to back in-house solutions to facilitate the digital migration of MSMEs during the pandemic, it instead has chosen to back startups that are already solving distinct problems for the same market — and have skin in the game.

And that’s given rise to IndiaMART, the strategic investor, beyond its growth as a standalone business.

Share price

However, even with more than Rs 900 crore in investments in the last year, IndiaMART’s share price has been falling. Its share price has plummeted by 48 percent — almost half of Rs 8,608 to Rs 4,471 on March 16.

Market capitalisation of IndiaMART InterMESH since listing

However, some analysts are hopeful. Axis Securities have set a target price of Rs 6,800/share.

In a report dated March 14, 2022, analysts at Axis Securities said with “a resilient business structure from a long-term perspective, supported by multiple verticals and higher penetrations in the rural areas of the country,” IndiaMART is well-positioned to capture the immense growth opportunity.

“Its robust technology backup supporting business platform, strong and consistent traffic improvement and margin tailwinds driven by cost efficiencies, lower input costs, and higher realisation, and healthy cash flow generation and acquisition strategy for inorganic growth,” is helping drive growth, the report said.

IndiaMART InterMESH vs. S&P BSE 500

Clearly, while IndiaMART has consistently outperformed the broader S&P BSE 500, its market capitalization does not capture the upside of its acquisition spree.

YourStory | TechStations | Flipboard | Bestinau | 99News | USMarket Today | wn.com