The second lockdown, following the more deadly second wave of the pandemic, has completely

disrupted the entire payments cycle that’s critical for small manufacturers like Chawla.

Sitting at his office in Ludhiana’s Jammu Colony, DS Chawla, a plastic parts supplier to cycle majors like

Avon, TI Cycles and Hero Ecotech, is combating lockdown-related issues daily. Stocks are piling up at his

godowns, a labour shortage looms, and suppliers are asking for payments to be cleared.

“From working 24×7, I first cut production to 6 days (8-hour shifts), then 5 days (8 hours shifts). Now

employees work on alternate days. All the big factories we supply to are shut currently, so we can’t ship

the finished goods, but we still have to continue manufacturing to fulfil pending orders and keep the

remaining labour busy,” said Chawla, proprietor, Chawla International.

The second lockdown, following the more deadly second wave of the pandemic, has completely

disrupted the entire payments cycle that’s critical for small manufacturers like Chawla.

“If we don’t supply, we don’t get paid. If we don’t get paid, how do we pay our suppliers. Small

businesses across the chain are cash strapped,” said Chawla, who is also president of United Cycle &

Parts Manufacturer Association.

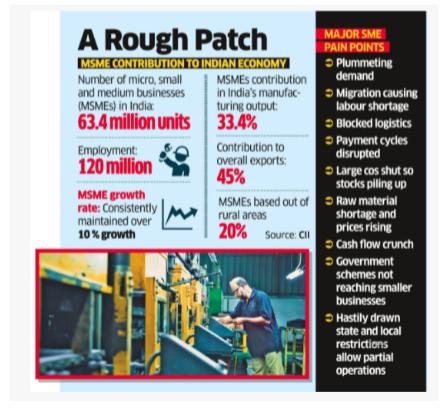

The restrictions have taken a heavy toll on lakhs of small businesses across the nation as they fight for

survival on the face of crippling labour shortage, disrupted supply chains, logistic blocks, raw material

shortages, serious cash flow problems—plunging demand.

Even in states that have allowed industrial activity to continue in lockdowns, major SME clusters like

Ludhiana, Kanpur, Madurai, Coimbatore, Cuttack, Tiruchirapalli, Agra and Rajkot, have reported major

drop in economic activity as large factories have shut down, or are operating at partial capacity, and

local demand has plummeted.

Footwear exporters in Agra were gearing up to raise production to meet the autumn and Christmas

demand from Europe and US when the state imposed Covid-19 restrictions impacting business activity.

“In 2020, after the first lockdown, our exports shrank by 30 per cent compared to 2019. In 2021, we expect a further 30 per cent dip in exports from 2020 levels. The whole leather ecosystem has been

impacted by the second wave at the time when we should be at peak production,” said Puran Dawar,

president, Agra Footwear Manufacturers & Exporters Chamber.

While SMEs catering to corporates or local markets struggle, small businesses that supply to

government departments are facing a different kind of challenge; a raw material shortage and rising

prices has meant that they will end up taking losses while fulfilling contracts at old rates.

“Steel prices have gone up substantially, so how do you supply finished goods at old rates? We will have

to fulfil the orders even if we are running losses to avoid penalties or being blacklisted. The government

should extend existing contracts or renegotiate contracts or cancel penalties,” says Jatinder Agrawal of

Amar Promoters, a Himachal Pradesh-based manufacturer who supplies steel products to various

government departments.

Since the restrictions started in the month of March, small businesses have also lost out on orders

companies and government departments dole out before closing their accounts for the year.

The second lockdown has pushed small businesses to the brink as they are unable to fulfil formal

banking requirements. For some, the choice is stark—shutter businesses or bear deeper losses.

“Even as we struggle with the second Covid wave, the banking sector is offering inadequate support to

the SMEs. After these many years, banks have not been able to pinpoint the main areas of concern for

SMEs. They just look at the balance sheets and some other requirements, but no one looks at the

potential of the business, employment generation capability, the challenges, the growth story,” said

Chandrakant Salunke, founder, SME Chamber of India.

The government had announced an Emergency Credit Line Guarantee Scheme (ECLGS) last year,

providing funding of up to Rs 3 lakh crore in the form of a fully guaranteed emergency credit line for

SMES.

And the scheme was even expanded to cover 26 distressed sectors and extended to June 30, but still a

large number of 45 lakh plus SMEs haven’t been able to take advantage of the scheme, especially the

micro and small businesses.

“The small businesses are still not getting the benefits because they still mostly rely on private finance,”

said Salunke.

The way some state governments rolled out restrictions also created hurdles for smaller businesses.

While the large and medium sized industries could run operations, smaller businesses like mechanics,

lathe machines, drilling shops etc, which are important for servicing the bigger businesses, were not

allowed to operate.

“I need a whole supporting ecosystem to run my factory. The state government needs to take

cognisance of this fact while framing regulations,” said Chawla.

The sudden lockdown in 2020 led to thousands of SMEs shutting shop or looking for exits, especially in

sectors like tourism, hospitality, real estate and retail and the industry representatives say the second

wave will end up taking a heavy toll as they are not in a financial condition to sustain operations.

“Since the pandemic started, 30 percent of small hotels and restaurants have shut shop and about 20

per cent are not operating at full capacity. The small hotels are on a negative list of financial institutions

and local governments are not helping them either. Only hotels that have taken loans are getting

financial help, but a lot of small hotels don’t have bank loans,” said Pradeep Shetty, secretary,

Federation of Hotel & Restaurants of India (FHRAI).

Industry veterans said the viability of SMEs is critical for post crisis economic recovery and failure to

protect them will put the economy at risk.

“The government has implemented a sizable number of programs aimed at addressing the needs of

SMEs. We foresee a faster recovery in months to come. The second wave of the pandemic is much

stronger, however, impact on the economy is moderate, primarily because the current lockdown not

being a nationwide one,” said Dinesh Agarwal- CEO, IndiaMART

Market watchers say the sudden, dramatic loss of demand severely affected the ability of SMEs to

function, and the resulting shutdown is now pushing many owners to explore sale of business.

“Amongst all the SMEs listed on our platform, 25% have quoted Covid onslaught as the primary reason

for sale and have reported a steep decline in revenues. This is more prevalent amongst restaurants,

playschools, training institutes, construction material businesses, food processing units, where almost

50% of them quote Covid as the reason for sale,” said Vishal Devanath, founder, Smergers, a private

marketplace for SME deals.

With revenue shrinking, small and medium businesses still have to bear expenses like employee salaries,

ESI and PF payments, electricity charges, interest payments and taxes but the government hasn’t

extended any direct help in dealing with such costs.

“The state wants all charges to be paid even now. But don’t they realise that generating revenues is very

difficult nowadays?” asked a sports goods manufacturer from Jalandhar.