Noida, India, April 29, 2021: IndiaMART InterMESH Limited (referred to as “IndiaMART” or the “Company”), today announced its financial results for the full year and fourth quarter ending March 31, 2021.

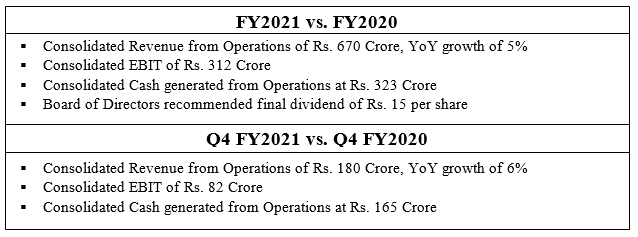

Financial Highlights (Q4 FY2021):

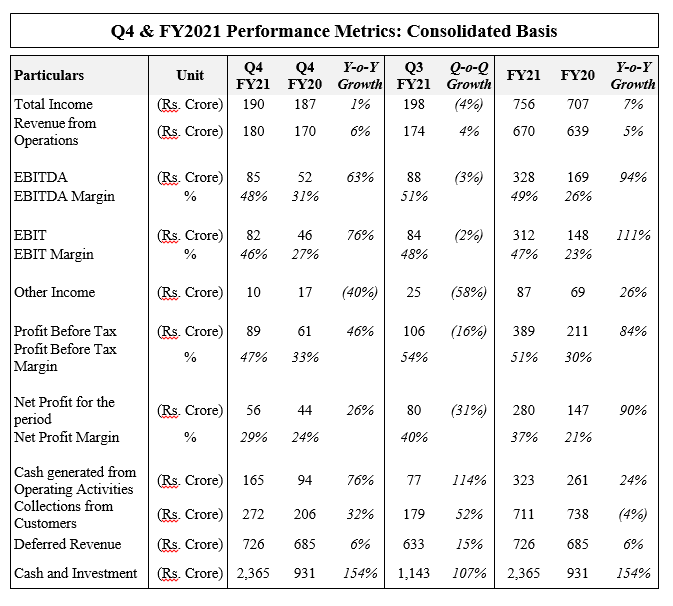

IndiaMART reported consolidated Total Revenue from Operations of Rs. 180 Crore in Q4 FY21, a growth of 6% y-o-y due to improvement in realization from existing customers and increase in number of paying subscription suppliers. Consolidated Deferred Revenue increased from Rs. 685 Crore in Q4 FY20 to Rs. 726 Crore in Q4 FY21.

Consolidated EBITDA was Rs. 85 Crore as compared to Rs. 52 Crore in Q4 FY20. Increase in EBITDA margin to 48% in Q4 FY21 from 31% in Q4 FY20 was primarily driven by sustained as well as temporary benefits arising from various cost optimization initiatives. Consolidated EBIT was Rs. 82 Crore as compared to Rs. 46 Crores in Q4 FY20, representing a growth of 76% y-o-y. EBIT margin increased to 46% in Q4 FY21 from 27% in Q4 FY20.

Profit before Tax was at Rs. 89 Crore and Net Profit was Rs. 56 Crores, representing margins of 47% and 29% respectively. The Board of Directors have recommended a final dividend of Rs. 15 per share for FY21, subject to shareholder approval.

Consolidated Cash Flow from Operations for the quarter was at Rs. 165 Crore. During Q4 FY21, IndiaMART has successfully completed QIP issue of equity shares by raising Rs. 1,070 Crores, the proceeds of which will be utilized for future growth and expansion. Cash and Investments balance stood at Rs. 2,365 Crore as on March 31, 2021 as compared to Rs. 931 Crore on March 31, 2020, an increase of 154% YoY.

Operational Highlights (Q4 FY2021):

IndiaMART registered a traffic growth of 42% YoY with 257 million in Q4 FY21 as compared to 180 million in Q4 FY20. Total business enquiries delivered increased to 150 million from 116 million, a growth of 29%. Supplier Storefronts grew to 6.5 million in Q4 FY21, an increase of 9% YoY and paying subscription suppliers grew to 152 thousand, a growth of 3%.

Further, we have recently acquired 11% equity stake in Legistify Services Private Limited, 25% equity stake in TruckHall Private Limited and 26% equity stake in Shipway Technologies Private limited, which are in the business of running SAAS solutions namely ‘Legistify’, ‘SuperProcure’ and ‘Shipway’ respectively. All these investments were completed through our 100% subsidiary, Trade zeal Online Private Limited.

Commenting on the performance, Mr. Dinesh Agarwal, Chief Executive Officer, said:

“We are happy to close the financial year with a modest growth in revenue and deferred revenue with healthy margins and cash flows. Strong response from global and domestic investors leading to successful closure of QIP offering in this volatile market environment further demonstrated their confidence in the business model. During these trying times, we remain committed to employee safety and customer centric approach helping businesses grow through on-line transformation. With a stronger balance sheet we will continue to invest in strengthening our value proposition further, positioning us well to leverage the emerging long term market opportunities.”

About IndiaMART:

IndiaMART is India’s largest online B2B marketplace for business products and services since. IndiaMART makes it easier to do business by connecting buyers and sellers across product categories and geographies in India through business enablement solutions. IndiaMART provides ease and convenience to the buyers by offering a wide assortment of products and a responsive seller base while offering lead generation, lead management and payment solutions to its sellers.

| IndiaMART InterMESH Ltd. CIN : L74899DL1999PLC101534 Corporate Office Tower 2, Assotech Business Cresterra, Floor No.6, Plot No.22, Sec 135, Noida-201305, U.P. Registered Office 1st Floor, 29-Daryaganj, Netaji Subash Marg, Delhi – 110002. For any queries, please contact: investors@indiamart.com |

MoneyControl | Pehal News | Global Prime News | Pune Metro | My Times Now | Latest LY |Bloomberg Quint | Business Standard | Investing.com | LiveMint