Noida, India, Jan 18, 2021: IndiaMART InterMESH Limited (referred to as “IndiaMART” or the

“Company”), today announced its financial results for the third quarter ending December 31, 2020.

Financial Highlights (Q3 FY2021):

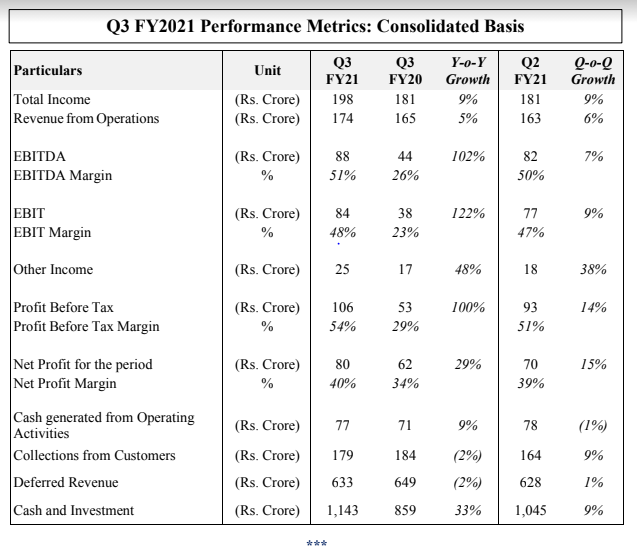

IndiaMART reported consolidated Total Revenue from Operations of Rs. 174 Crore in Q3 FY21, a growth

of 5% y-o-y due to marginal improvement in realization of existing customers and increase in number of

paying subscription suppliers. Consolidated Deferred Revenue declined from Rs. 649 Crore in Q3 FY20 to

Rs. 633 Crore in Q3 FY21.

Consolidated EBITDA was Rs. 88 Crore as compared to Rs. 44 Crore in Q3 FY20. Increase in EBITDA

margin to 51% in Q3 FY21 from 26% in Q3 FY20 was primarily driven by sustained as well as temporary

benefits arising from various cost optimization initiatives. Consolidated EBIT was Rs. 84 Crore a

compared to Rs. 38 Crores in Q3 FY20, representing a growth of 122% y-o-y. EBIT margin increased to

48% in Q3 FY21 from 23% in Q3 FY20.

Profit before Tax was at Rs. 106 Crore and Net Profit was Rs.80 Crores, representing margins of 54% and

40% respectively.

Consolidated Cash Flow from Operations for the quarter was at Rs. 77 Crore. Cash and Investments balance

stood at Rs. 1,143 Crore as on December 31, 2020 as compared to Rs. 859 Crore on December 31, 2019,

an increase of 33% YoY.

Operational Highlights (Q3 FY2021):

IndiaMART registered a traffic growth of 35% YoY with 253 million in Q3 FY21 as compared to 188

million in Q3 FY20. Total business enquiries delivered increased to 154 million from 112 million, a growth

of 37%. Supplier Storefronts grew to 6.4 million in Q3 FY21, an increase of 9% YoY and paying

subscription suppliers grew to 148 thousand, a growth of 5%.

Q3 FY2021 vs. Q3 FY2020

Consolidated Revenue from Operations of Rs. 174 Crore, YoY growth of 5%

Consolidated EBIT of Rs. 84 Crore

Consolidated Cash generated from Operations at Rs. 77 Crore

Commenting on the performance, Mr. Dinesh Agarwal, Chief Executive Officer, said:

“We are pleased to report a resilient financial performance this quarter with steady recovery in the business

parameters while maintaining healthy margins and cashflows. As we see the improvement in overall

demand environment and business activity, our strong value proposition, customer relationships and

balance sheet make us confident of supporting businesses in their transformation to online. With the

emerging accelerated digitization needs of businesses, we are looking forward to kickstart the new year on

an optimistic note.”

About IndiaMART:

IndiaMART is India’s largest online B2B1 marketplace for business products and services. IndiaMART

makes it easier to do business by connecting buyers and sellers across product categories and geographies

in India through business enablement solutions. IndiaMART provides ease and convenience to the buyers

by offering a wide assortment of products and a responsive seller base while offering lead generation, lead

management and payment solutions to its sellers.

IndiaMART InterMESH Ltd.

CIN : L74899DL1999PLC101534

Corporate Office

Tower 2, Assotech Business Cresterra,

Floor No.6, Plot No.22, Sec 135,

Noida-201305, U.P.

Registered Office

1st Floor, 29-Daryaganj, Netaji Subash Marg, Delhi – 110002.

For any queries, please contact: investors@indiamart.com

IIFL | IANS | Economic Times | Equity Bulls | Business Standard | Medianama | Latestly |Yahoo Finance |MoneyControl |Eflip | Dailyhunt | Business Journal | MyTimesNow | Prokerala | Lokmat |Siasat | TFI Post | Fashion Network | Telecomlive | WebIndia1232 | INDNews |DaijiWorld |Windistonews |Newsfeel |Forevernews |On Indian | SD Indian | Chicago Indian | AustinIndian | VirginaIndian | NMIndian | SeatleIndia | MainiIndan |