- IndiaMART has posted a moderate performance for the second quarter of the current financial year.

- In an interview with Business Insider, Dinesh Agarwal, CEO, IndiaMART said that the COVID impact hasn’t completely worn off and also spoke about JD Mart’s launch.

- Agarwal said that one of the biggest differences has been that the lockdown has resulted in a 30-40% growth in their buyer side traction.

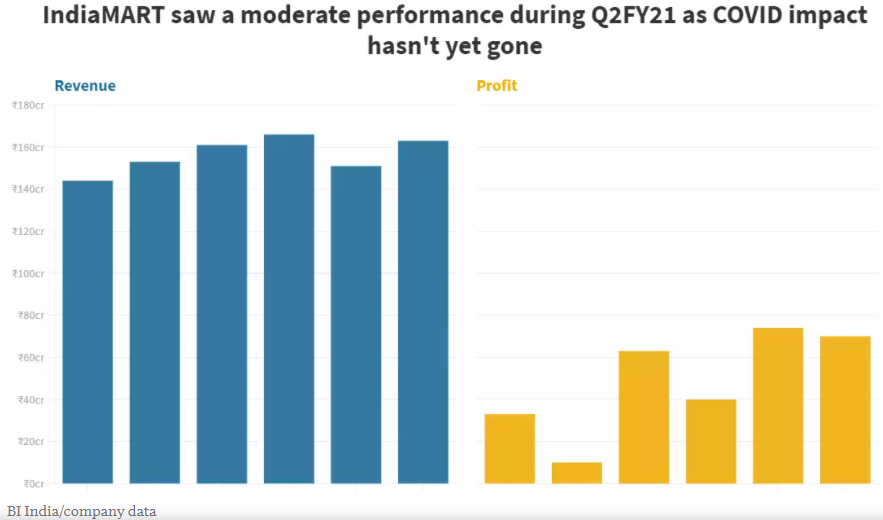

Indian Business-to-Business e-commerce platform IndiaMART has clocked in moderate performance for the second quarter of the current financial year. Its revenue from operations rose 4% at ₹163 crore, while its consolidated EBIT stood at ₹77 crore, up 147% on a year-on-year basis.

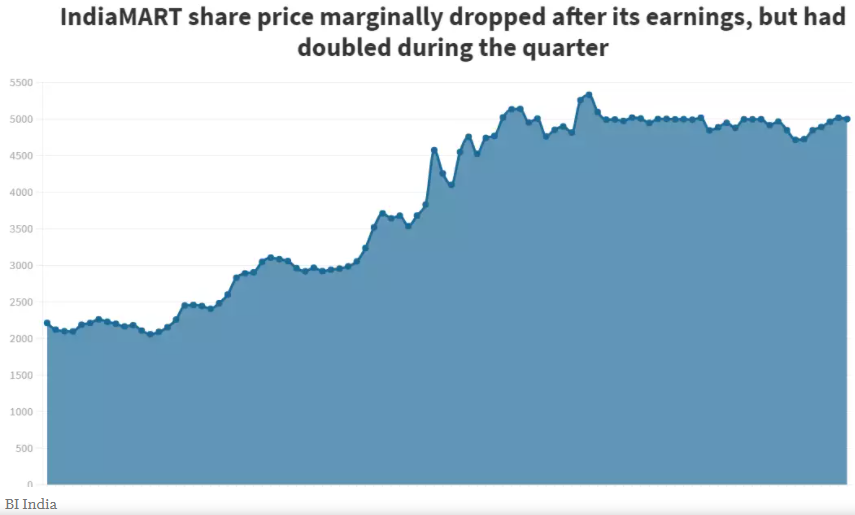

Its net profit shows an eight-fold surge, but IndiaMART CEO Dinesh Agarwal attributed that as a one-time jump due to a tax readjustment last year. On a quarterly basis, its profit fell by 6%, resulting in a marginal dip in its share price on Tuesday. However, IndiaMART’s share price has more than doubled during the quarter.

Competition is rising for the country’s oldest e-commerce platform IndiaMART, with Just Dial launching its B2B e-commerce platform, and the push from Amazon and Flipkart in the B2B space.

Competition from JD Mart

Justdial – the 24-year old local discovery platform –- is set to launch its own B2B (business to business) marketplace called JD Mart. This will be in direct competition to IndiaMart, which has had an unchallenged run for 24 years.

But Agarwal isn’t worried about competition from JD Mart, at least not right away. “There are various kinds of B2B businesses and there are players like Amazon, Walmart. Let us see what JD Mart comes up with,” he said.

Agarwal said that you can build a feature, but the kind of data, insights and algorithms IndiaMART has put together over the years can’t be launched overnight. “It will be a 3-5 year journey and at the end of it the buyers and sellers will see who offers a better value proposition to them. For any new player to do sales is one thing, but getting the product right is a long term plan. We didn’t build IndiaMART over a couple of quarters. Just Dial is a great company and I’m sure they will find something new, some day,” said Agarwal.

Still dealing with the COVID impact

During an interview with Business Insider, IndiaMART CEO Dinesh Agarwal explained the two main changes that the company dealt with during the second quarter. “There has been a definite shift in online adoption and the second, the kind of fear everyone had in mind initially has gone away. So, the overall economy has started to move on from June,” he said.

Agarwal added that the COVID impact hasn’t completely worn off as 20% industries listed on IndiaMART continue to struggle while 30-49% of them are doing better than pre-COVID time too.

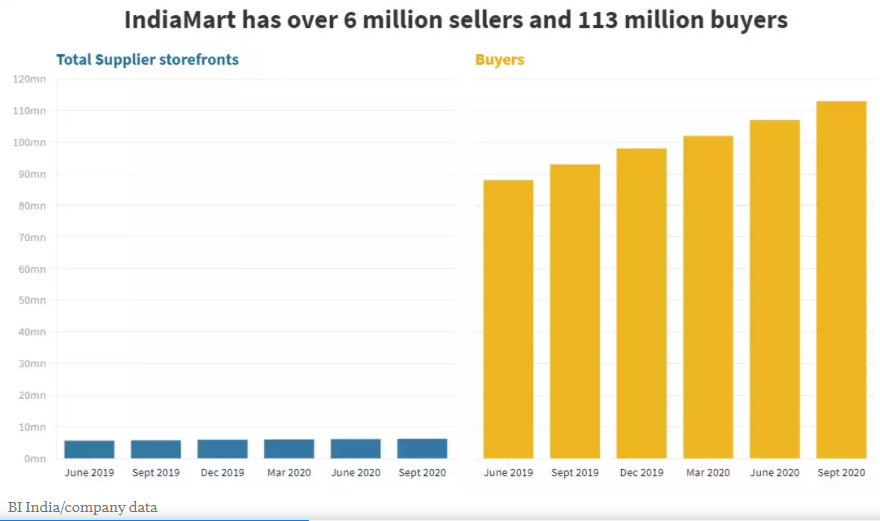

One of the biggest differences has been that the lockdown has resulted in a 30-40% growth in their buyer side traction. “The number of buyers have gone up and their repeat rates have also gone up. Our number of buyers has gone up 30-40% from last year and the repeat rate from those buyers has gone up from 55% to 60%, which has further strengthened our network effect,” he said.

With the economy opening up, offline retail once again poses competition to IndiaMART. Agarwal agrees but adds that the adoption of online seen in April, May and June is higher than ever before, and the impact continued even in the second quarter. “Even if 5% of people go back to offline, the new normal of the internet has happened and it’s not going to vanish,” he said.

However, IndiaMART’s seller subscribers are yet to reach its pre-COVID levels and Agarwal believes it will take four-five months for them to completely get back to normal.

Betting on tech and AI

Agarwal understands that most of his buyers come from smaller cities for whom ‘search’ and using correct English might not be the first option. And that’s why IndiaMART continues to invest in voice search, AI/ML and language options for sellers and buyers. “For example, even if you write 300 different spellings of jewellery on IndiaMART, you will still get the right result,” he said.

And that’s why the company doesn’t shy away from tech investments. Of IndiaMART’s total expenses, 20% of it goes into investing in products and technology. And out of the 4500 employees, 20% of them are in product and technology.