Analysts and investors are hoping that 2020 too will produce a few multi-bagger debutants.

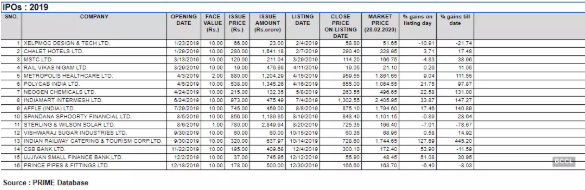

Mumbai: Five of the 16 initial public offerings of calendar 2019 doubled investor money over the past few months in an volatile market.

With a long list of issues lined up for this year, analysts and investors are hoping that 2020 too will produce a few multi-bagger debutants. The analysts say the performance of the ongoing Rs 10,000 crore SBI Cards and Payment Services issue is likely to have a bearing on how the primary market behaves through the year.

As many as 12 of the 16 IPOs that hit the market last year are trading with gains till date, while four failed to deliver returns.

The issue of state-run Indian Railway Catering & Tourism Corporation (IRCTCNSE -8.60 %) was the star performer, with the shares jumping a whopping 445 per cent since its debut in September, 2019. The stock hit a record high of Rs 1,995 on February 25 from its issue price of Rs 320 per share.

The other star performers included Metropolis Healthcare, Neogen Chemicals, Indiamart Intermesh and Affle (India), data from primary market tracker Prime Database showed.

The IPO market had a lackluster start to calendar 2020 until the much-awaited SBI Card issue hit the market earlier this week, creating a lot of buzz.

The issue had been subscribed 15 times till the start of fourth and last day of the bidding process. Bankers expect the issue to be subscribed 30 to 35 times as high networth individuals (HNIs) are expected to place most of their bids on the last day, specially reserved for them and retail investors on Thursday.

“A lot will depend on SBI Card listing, and how that pans out. Given the entire coronavirus scare the secondary market is already facing the brunt of it,” said Pranav Haldea, Managing Director of Prime Database.

The impact was visible in the unlisted market. Even as the IPO mopped up solid subscriptions, unlisted shares of the company took a knock in the unofficial market for trading in such shares.

The seven-day losing streak of the secondary market and jitters created by

oronavirus outbreak in the national capital caused panic in the unlisted market, and the premium that the unlisted shares of SBI Card enjoyed halved.

Dealers in the unlisted market said the premium on the counter, which was around Rs 380-390 a week ago, has plunged over 65 per cent to Rs 130-140 as of Wednesday.

“When the secondary market is volatile, primary issuances will be hit. Till the time the entire situation stabilises, I doubt there will be more issuances in the market,” Haldea said.

IPOs worth around Rs 21,080 crore are waiting with Sebi approvals to hit the market.

“Fortunately, the quality of IPOs that came in 2019 was better, and their business models were different. This season, the IPO process has started with SBI Card, which is a company to hold in a portfolio,” said

Deven Choksey, Group Managing Director, KR Choksey Investment Managers

“The gains on listing and beyond would depend on how the secondary market performs,” he said.

Choksey was concerned that almost 95 per cent of IPO money is funded by financiers. “The issue will sail through, but because of coronavirus scare, the secondary market is subdued. So problems may erupt post listing. We need to wait and watch what happens at the IPO listing,” he said.