MINT,

Small- and medium-sized enterprises (SMEs) will bear the brunt of the interest rate hikes by the Reserve Bank of India on 25 January, according to a study by ratings agency Crisil Ltd.

SMEs account for 8% of India’s gross domestic product and 40% of exports. With growth already hampered by limited borrowing power, they are likely to fare worse than large companies, it said.

“Larger corporates are also affected by rising interest rates, but SMEs’ relative bargaining power, ability to pass on price increases, negotiating for finer terms, etc., would be lesser as compared to larger corporates,” Crisil said.

Ramraj Pai, director of Crisil’s SME ratings, said smaller businesses rely on their own resources to fund growth and are going to feel added pressure on their portfolio of borrowings.

Based on a sample of more than 3,000 businesses, Crisil said as many as one-fifth could face erosion of up to a quarter of pre-tax profit.

Every percentage increase raised the interest payout by Rs.1 per Rs.10 of debt, resulting in 10% erosion in profitability, according to the report.

However, given the limited borrowing capacity, margin pressures will be mitigated, it said.

“If SMEs can, in a rising interest rate scenario, be more conservative in their borrowing plans, that would mitigate the interest rate impact,” said Pai, also the report’s author. “The only caveat being that any enterprise will have to balance the requirements of business growth and funding in deciding its optimal funding mix.”

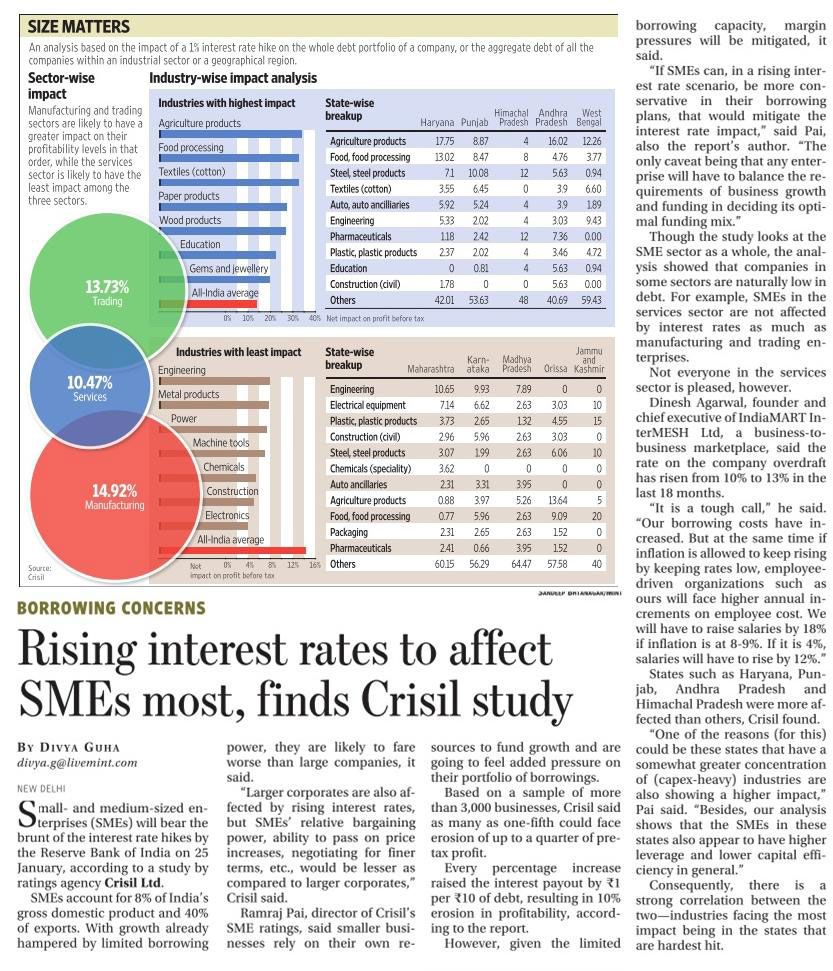

Though the study looks at the SME sector as a whole, the analysis showed that companies in some sectors are naturally low in debt. For example, SMEs in the services sector are not affected by interest rates as much as manufacturing and trading enterprises.

Not everyone in the services sector is pleased, however.

Dinesh Agarwal, founder and chief executive of IndiaMART InterMESH Ltd, a business-to-business marketplace, said the rate on the company overdraft has risen from 10% to 13% in the last 18 months.

“It is a tough call,” he said. “Our borrowing costs have increased. But at the same time if inflation is allowed to keep rising by keeping rates low, employee-driven organizations such as ours will face higher annual increments on employee cost. We will have to raise salaries by 18% if inflation is at 8-9%. If it is 4%, salaries will have to rise by 12%.”

States such as Haryana, Punjab, Andhra Pradesh and Himachal Pradesh were more affected than others, Crisil found.

“One of the reasons (for this) could be these states that have a somewhat greater concentration of (capex-heavy) industries are also showing a higher impact,” Pai said. “Besides, our analysis shows that the SMEs in these states also appear to have higher leverage and lower capital efficiency in general.”

Consequently, there is a strong correlation between the two—industries facing the most impact being in the states that are hardest hit.