Business World,

Boom, bust and the balancing act — these veterans have seen it all, and survived to grow better and bigger

In August last year, when Gurgaon-based Makemytrip.com (MMT) listed on Nasdaq, its CEO and founder Deep Kalra felt vindicated.

One of the few survivors of the dotcom bust, Kalra’s decision not to shut shop despite its original investor venture capital (VC) firm eVentures withdrawing its $2-million funding in 2001, had paid off.

MMT’s debut trade on Nasdaq almost doubled its valuation at $902.8 million and its shares shot up by 88.9 per cent over its initial public offering of $14.

Having studied the growth of international travel sites such as Expedia.com, Kalra founded MMT in 2000 (launching it first in the US) firmly believing that online travel booking was the next big thing.

But after the dotcom crash and 9/11, he found it tough to raise money. Kalra had two options — either buy back equity or shut shop and go back to a regular job. He decided to pursue the first; took money from angel investors, put in his personal savings, cut costs and held tight.

“I am a data-driven animal, and with data, we saw the graphs (of investment and profits) would be in the intersection. But the challenge was for the next 24 months.” Kalra persisted, and his diligence paid off. Today, the company is valued at over a billion dollars.

Kalra’s decision to initially concentrate on the non-resident Indian (NRI) market and not undertake costly promotions in India probably helped him endure. During 2001-02, the travel and tourism industry was ravaged by a series of storms (9/11, SARS epidemic, etc.) and the discretionary travel market plummeted.

However, the NRI market was unaffected as people continued to visit friends and family in India. Further, Kalra stopped initial promotions in India as he realised the market wasn’t fully developed. This helped him conserve money, while others burnt their fingers in a premature online market.

Of course, cost cutting and saving precious dollars was the key to MMT’s survival. Kalra cut employee strength from 42 to 23 and took no salary. Another strategy was to slowly move to non-air sectors. MMT started offering railway and bus tickets, and entered into tie-ups with hotels. Slowly, it has been expanding this side of the business. Moreover, Kalra has always been a hands-on person. He put in a system where he directly looked into all complaints, providing better customer service.

More Brave Souls

Like Kalra, a few others have continued to believe in the dotcom space. Hitesh Oberoi, COO of Info Edge, which owns Naukri.com, is one. Naukri got VC funds in April 2000, just before the dotcom bust.

But Oberoi knew that though they had the money, the next round of funding would be difficult. Hence, instead of wasting it on advertising, he decided to conserve the cash. A couple of years later, when the slump was over, Info Edge was ready to invest once more.

While Naukri.com continues to be Info Edge’s highest revenue earner, contributing 80 per cent to the kitty, Oberoi has now diversified into many online portals such as 99acres.com, a real estate broking site, and matrimonial portal Jeevansathi.com, which does strong business in north India. It earns revenues of about Rs 20 crore and has broken even.

However, the business is very fragmented, and the website has not been able to make much headway in either south India, dominated by Bharatmatrimony (estimated business of Rs 50-60 crore), or eastern India and Gujarat where Shaadi.com rules. 99acres, on the other hand, is on shaky ground. “We want to grow our topline rather than our bottom line today, but we are trying hard to get 99acres to break even,” says Oberoi.

Another dotcom entrepreneur who decided to stick it out is Dinesh Agarwal, founder of IndiaMART.com, a venture started in 1996. Though the firm posted revenues of only Rs 90 crore in 2009-10, its valuation is around Rs 600 crore. IndiaMART is a business-to-business (B2B) portal focusing solely on the SME (small and medium enterprises) sector. Over the years, it has built a huge portfolio of customers. In 2001, it had 50,000 firms on the site selling products and by 2004, this number rose to 300,000.

What Agarwal did was to build an ecosystem. Even today, 97 per cent of products and firms on the site are unpaid. But space priority is given to paid vendors — the upper half of the page is for them. As Agarwal adds more categories to the existing 40,000 and the number of products and companies are increased, the ratio between paid and unpaid vendors might change. Paid vendors may increase to 8-10 per cent.

Meanwhile, the B2B space is getting cluttered with global players such as Alibaba.com also having entered the Indian market. However, Agarwal remains unmoved. “Our search is far better than that of Alibaba.com and Business.com. We invest heavily in the backend of the site,” he explains.

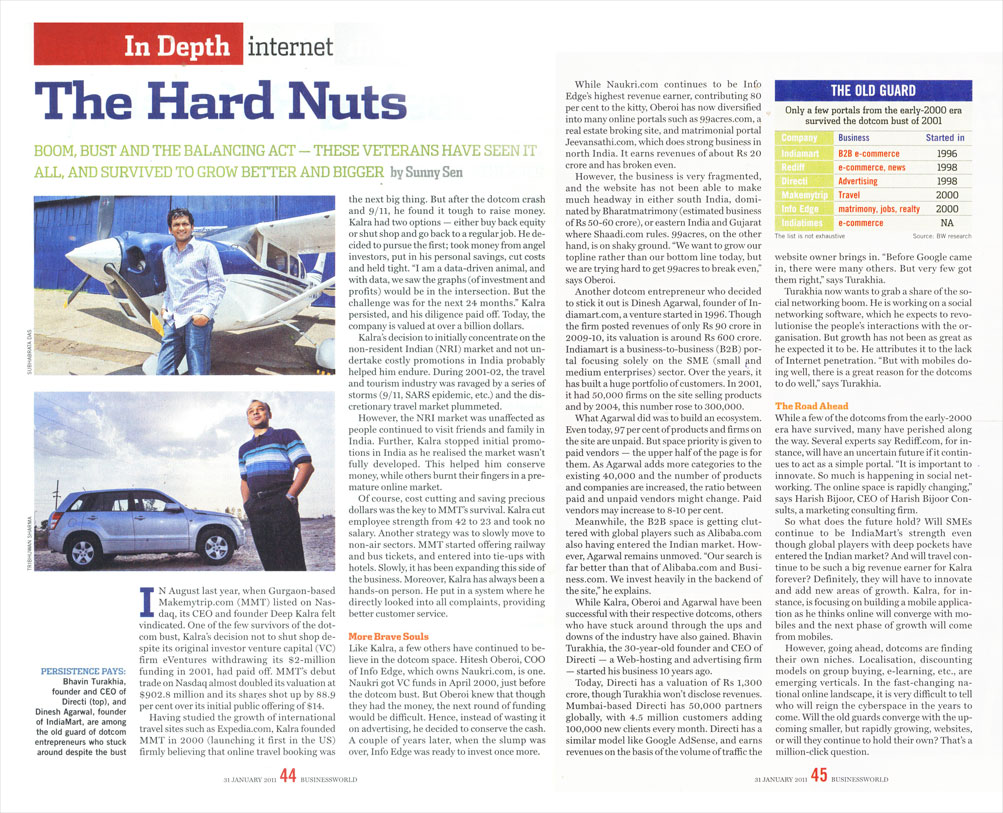

While Kalra, Oberoi and Agarwal have been successful with their respective dotcoms, others who have stuck around through the ups and downs of the industry have also gained. Bhavin Turakhia, the 30-year-old founder and CEO of Directi — a Web-hosting and advertising firm — started his business 10 years ago.

Today, Directi has a valuation of Rs 1,300 crore, though Turakhia won’t disclose revenues. Mumbai-based Directi has 50,000 partners globally, with 4.5 million customers adding 100,000 new clients every month. Directi has a similar model like Google AdSense, and earns revenues on the basis of the volume of traffic the website owner brings in. “Before Google came in, there were many others. But very few got them right,” says Turakhia.

Turakhia now wants to grab a share of the social networking boom. He is working on a social networking software, which he expects to revolutionise the people’s interactions with the organisation.

But growth has not been as great as he expected it to be. He attributes it to the lack of Internet penetration. “But with mobiles doing well, there is a great reason for the dotcoms to do well,” says Turakhia.

The Road Ahead

While a few of the dotcoms from the early-2000 era have survived, many have perished along the way. Several experts say Rediff.com, for instance, will have an uncertain future if it continues to act as a simple portal. “It is important to innovate. So much is happening in social networking. The online space is rapidly changing,” says Harish Bijoor, CEO of Harish Bijoor Consults, a marketing consulting firm.

So what does the future hold? Will SMEs continue to be IndiaMART’s strength even though global players with deep pockets have entered the Indian market? And will travel continue to be such a big revenue earner for Kalra forever? Definitely, they will have to innovate and add new areas of growth. Kalra, for instance, is focusing on building a mobile application as he thinks online will converge with mobiles and the next phase of growth will come from mobiles.

However, going ahead, dotcoms are finding their own niches. Localisation, discounting models on group buying, e-learning, etc., are emerging verticals. In the fast-changing national online landscape, it is very difficult to tell who will reign the cyberspace in the years to come. Will the old guards converge with the upcoming smaller, but rapidly growing, websites, or will they continue to hold their own? That’s a million-click question.