Business Today,

ALLITERATIVE APPEAL APART, STUDYING DELHI’S dotcom detritus can be an enlightening experience. This is just a reporter’s informed (Ha!) opinion, but at the peak of the hype cycle it was India’s capital city that hosted the dotcoms with the most harebrained business models. www starts-ups in Chennai and Bangalore went the tech way, most of those that sprouted in Mumbai did what the city’s movers do, leverage arbitrage, but it was Delhi’s dotcoms that explored the hights of irrational exuberance. One city dotcom delhigossip.com, tried to build community around gossip-mongers and make money from advertising.

The volatile mix of dotcom hubris, and Delhi’s proclivity for ostentiotation and its get-rich-quick culture resulted in flashy cars and flashier offices. In 1999, there existed around 25,000 registered dotcoms in the country, propelled by investments in the range of Rs. 500-700 crore from generous angels. By 2000, the numbers had gone only up, with investements shooting up to Rs 2,2000 crore. Then the bottom fell out of the market.

The volatile mix of dotcom hubris, and Delhi’s proclivity for ostentiotation and its get-rich-quick culture resulted in flashy cars and flashier offices. In 1999, there existed around 25,000 registered dotcoms in the country, propelled by investments in the range of Rs. 500-700 crore from generous angels. By 2000, the numbers had gone only up, with investements shooting up to Rs 2,2000 crore. Then the bottom fell out of the market.

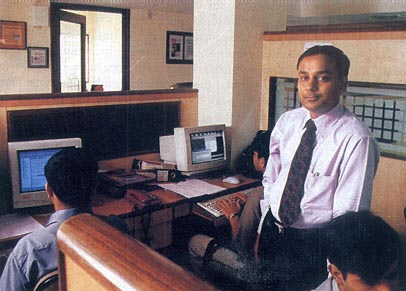

Not for everyone; Dinesh Aggarwal’s Indiamart.com survived (as did many others). His P2P (path to profitability, a term popular with dot commers): patience and progenitors.” My traditional business background helped,” says the 32-years old CEO. As did the fact that Indiamart underwent numerous changes before settling on its current business model: from a pure HTM-based online catalogue of small and medium-sized Indian companies seeking export opportunities, to a B2B site facilitating auction, tenders, and electronic trade offers. Today, sitting in his new office -it cost Rs. 2.5 crore in NOIDA ( a Delhi-satellite) Aggarwal, who employs around 170 people, claims Indiamart was never a dotcom in the conventional sense of the term. Business wasn’t bad in 2001-02: revenues of Rs. 4.18 crore and earnings of Rs. 9.5 lakh.

NOIDA, and Okhla, are popular destinations for dotcoms that are still around. Aggarwal moved because he wanted more space, but most others do from financial considerations…