Noida, India, July 20, 2023: IndiaMART InterMESH Limited (referred to as “IndiaMART” or the “Company”), today announced its financial results for the first quarter ending June 30, 2023.

| Q1 FY2024 vs. Q1 FY2023 |

| • Consolidated Revenue from Operations of Rs. 282 Crore, YoY growth of 26% • Consolidated Cash generated from Operations at Rs. 91 Crore • Consolidated Net Profit of Rs. 83 Crore • Board of directors approved a buyback of 1,250,000 Equity shares at Rs 4,000 per equity share, for an amount not exceeding Rs. 500 Crore, subject to approval of shareholders |

Financial Highlights (Q1 FY2024):

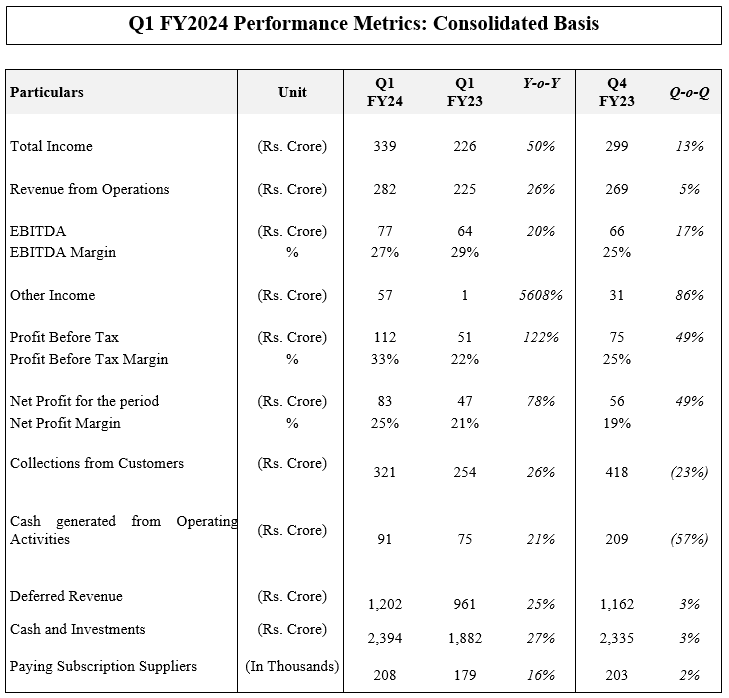

IndiaMART reported consolidated Revenue from Operations of Rs. 282 Crore in Q1 FY24, a growth of 26% YoY primarily driven by 16% increase in number of paying subscription suppliers. Standalone Revenue from Operations of IndiaMART and Busy Infotech stood at Rs. 268 Crore and Rs. 13 Crore in Q1 FY24 representing a YoY growth of 25% and 26% respectively. Consolidated Deferred Revenue increased by 25% YoY to Rs. 1,202 Crore as on June 30, 2023.

The Company continued making growth investments in manpower, product and technology, sales and servicing resulting into growth in revenue and paying subscription suppliers. As a result, Standalone EBITDA stood at Rs. 76 Crore for Q1 FY24 representing EBITDA margin of 28%. Consolidated EBITDA stood at Rs. 77 Crore for Q1 FY24 representing EBITDA margin of 27%.

The Other Income increased to Rs. 57 crores primarily due to fair value gain on treasury investments. Consolidated Net Profit for this quarter was Rs. 83 Crore representing margin of 25%.

Consolidated Cash Flow from Operations for the quarter was at Rs. 91 Crore. Cash and Investments balance stood at Rs. 2,394 Crore as on June 30, 2023.

Operational Highlights (Q1 FY2024):

IndiaMART registered traffic of 254 million and Unique business enquiries of 22 million in Q1 FY24. Supplier Storefronts grew to 7.6 million, an increase of 6% YoY and paying subscription suppliers grew to 207,683 a net addition of 4,993 subscribers during the quarter.

Commenting on the performance, Mr. Dinesh Agarwal, Chief Executive Officer, said:

“We are pleased with the healthy growth in revenue, deferred revenue, cash flows along with steady operating margins as we start the new fiscal. We are confident about the continued growth and will continue to invest in technology and people to strengthen our value proposition further to accelerate digital adoption amongst businesses. Our sustainable cashflow helps us in making these investments towards building a strong foundation to leverage emerging growth opportunities.”

Online Coverage :

LatestLY (PTI) | UNI | Business Standard | ET Now | Economic Times | ET Retail | Financial Express | Free Press Journal | CNBC TV 18 | CNBC TV 18 (Twitter) | Zee Business | Devdiscourse | BQ Prime | The Daily Check | BQ Prime | Mint | ET Markets | Daily Hunt | BQ Prime | Equity Bulls | Money Control | News Drum | Knowledia | IPO Central | Jantaserishta |CNBC TV 18 Hindi | Business Standard (Hindi)