IndiaMART InterMESH Ltd, a B2B e-commerce company, on Thursday reported a 60.68 per cent rise in its consolidated net profit to Rs 112.8 crore for the third quarter ended December 31, 2022.

Financial Highlights (Q3 FY2023):

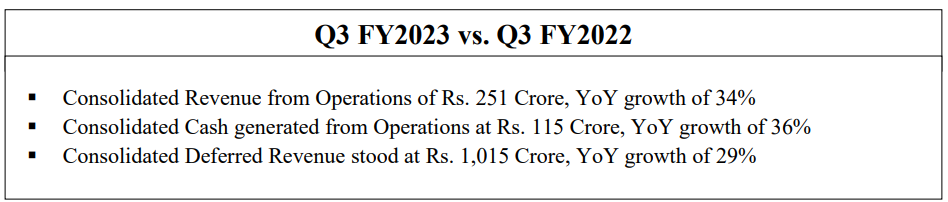

IndiaMART reported consolidated Revenue from Operations of Rs. 251 Crore in Q3 FY23, a growth of

34% YoY primarily driven by 24% increase in number of paying subscription suppliers and addition of Rs.

10 Crore revenue from accounting software services. Consolidated Deferred Revenue increased by 29%

YoY to Rs. 1,015 Crore as on December 31, 2022.

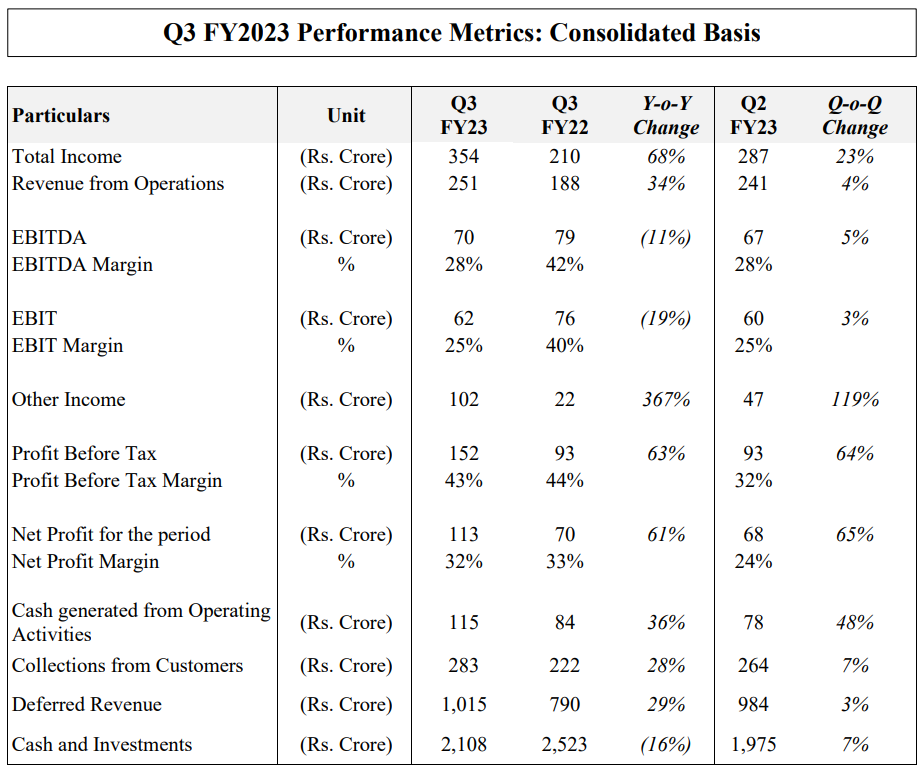

The Company continued making growth investments in manpower, product and technology, sales and

servicing resulting into growth in revenue and paying subscription suppliers. As a result, consolidated

EBITDA was Rs. 70 Crore for Q3 FY23 representing EBITDA margin of 28%.

The Other Income increased to Rs. 102 crores on primarily due to one-time realized and unrealized gain of

Rs. 67 crores on measurement and sale of investment in other entities. Net Profit for this quarter was Rs.

113 Crore representing margin of 32%.

Consolidated Cash Flow from Operations for the quarter was at Rs. 115 Crore. Cash and Investments

balance stood at Rs. 2,108 Crore as on December 31, 2022.

Operational Highlights (Q3 FY2023):

IndiaMART registered traffic of 250 million and Total business enquiries of 119 million during Q3 FY23.

Supplier Storefronts grew to 7.4 million, an increase of 6% YoY and paying subscription suppliers grew

by 24% YoY to 194,355 with a net addition of 6,263 paying subscription suppliers during the quarter.

About IndiaMART:

IndiaMART is India’s largest online B2B marketplace for business products and services. IndiaMART

makes it easier to do business by connecting buyers and sellers across product categories and geographies

in India through business enablement solutions. IndiaMART provides ease and convenience to the buyers

by offering a wide assortment of products and a responsive seller base while offering lead generation, lead

management and payment solutions to its sellers.

Business Standard (Capital market) | Business Standard (PTI) | UNI India | Mint Genie | ET Retail | Money Control | Inc 42 | Zee Business | MSN.in | Equity Bulls | Latest LY | Newsdrum | Business News This Week | Media Bulletins | Content Media Solution | Smart Business News | Biz News Desk | Business News Week | Online Media Cafe | Safaqna.com | Typology Pro | Knowledia | HT Syndication