Noida, India, October 21, 2021: IndiaMART InterMESH Limited (referred to as “IndiaMART” or the “Company”), today announced its financial results for the second quarter ending September 30, 2021.

Financial Highlights (Q2 FY2022):

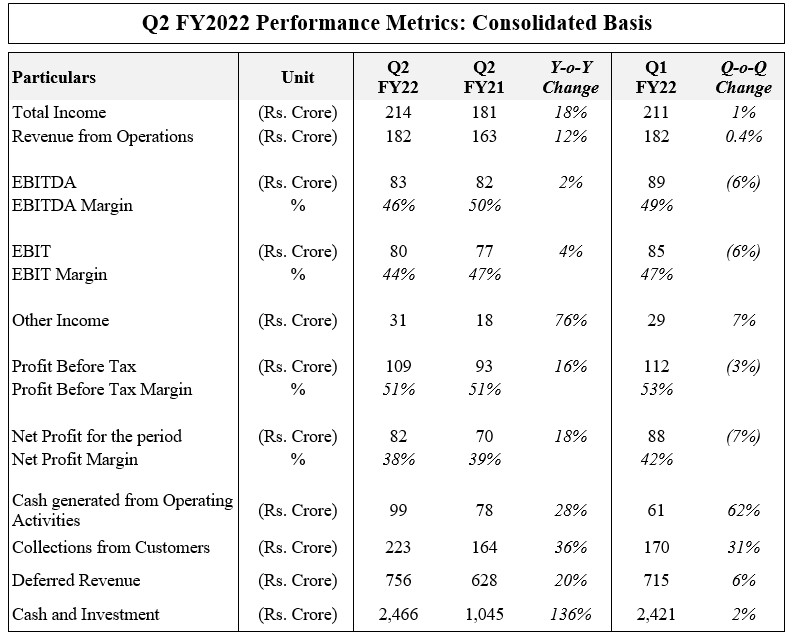

IndiaMART reported consolidated Total Revenue from Operations of Rs. 182 Crore in Q2 FY22, a growth of 12% YoY driven by improvement in realization from existing customers and increase in number of paying subscription suppliers. Consolidated Deferred Revenue grew by 20% YoY to Rs. 756 Crore as at 30 September 2021.

Consolidated EBITDA was Rs. 83 Crore as compared to Rs. 82 Crore in Q2 FY21. EBITDA margin for Q2 FY22 stood at 46%. Consolidated EBIT for the period was Rs. 80 Crore with EBIT margin of 44% in Q2 FY22.

Profit before Tax was at Rs.109 Crore and Net Profit was Rs.82 Crores, representing margins of 51% and 38% respectively. Consolidated Cash Flow from Operations for the quarter was at Rs. 99 Crore, a year on year growth of 28%. Cash and Investments balance stood at Rs. 2,466 Crore as on September 30, 2021, as compared to Rs. 1,045 Crore on September 30, 2020, an increase of 136% YoY.

Operational Highlights (Q2 FY2022):

IndiaMART registered a traffic growth 10% YoY with 284 million in Q2 FY22 as compared to 259 million in Q2 FY21 and Unique business enquiries stood at 26 million in Q2 FY22. Supplier Storefronts grew to 6.7 million, an increase of 7% YoY and paying subscription suppliers grew to 150 thousand, a growth of 6%. Further, we have acquired 26% stake in ‘Agillos E-Commerce’ which under the brand name of ‘Aerchain’, offers SaaS based solutions allowing mid to large sized enterprises to automate their procurement operations. Aerchain offers solutions across the entire Source to Pay lifecycle of enterprises. Investment was completed through our 100% subsidiary, Trade Zeal Online Private Limited.

Commenting on the performance, Mr. Dinesh Agarwal, Chief Executive Officer, said:

“We are pleased with the visible recovery momentum across business leading to modest growth in revenue, customers and deferred revenue in this quarter. Our strong balance sheet and cash flows from operations give us the wherewithal to help businesses transform, adopt digitalization and grow themselves in these times. We continue to make the right investments needed to strengthen our value proposition, and positioning while leveraging the emerging growth tailwind to create the long term shareholder value.”

About IndiaMART:

IndiaMART is India’s largest online B2B marketplace for business products and services. IndiaMART makes it easier to do business by connecting buyers and sellers across product categories and geographies in India through business enablement solutions. IndiaMART provides ease and convenience to the buyers by offering a wide assortment of products and a responsive seller base while offering lead generation, lead management and payment solutions to its sellers.

IndiaMART InterMESH Ltd.

CIN :L74899DL1999PLC101534

Corporate Office

Tower 2, Assotech Business Cresterra,

Floor No.6, Plot No.22, Sec 135,

Noida-201305, U.P.

Registered Office

1st Floor, 29-Daryaganj, Netaji Subash Marg, Delhi – 110002.

For any queries, please contact: investors@indiamart.com

ET Retail | Inc42 | Business Standard | IIFL Securities | Business Today | Money Control | ZEE Business | Equity Bulls | HT Syndication