- IndiaMart’s CEO Dinesh Agarwal highlighted that almost 80% of Indian MSMEs have such low turnover that they are not eligible to register for GST.

- BharatPe’s group president Suhail Sameer said that the system also needs to change to stop benefiting large businesses at every step of the way.

- People who need credit can’t, unfortunately, be underwritten according to Sameer.

Many have termed 2020 as the watershed moment for the Indian micro, small and medium enterprise (MSMEs) that will accelerate their business growth with the digital transformation. However, the segment still continues to struggle with the traditional system set in place to offer support to them.

On the second day of Business Insider’s two day event ‘MSME Exchange 2021’, several politicians, business leaders, bankers and investors joined in to discuss how to not only support, but enable the Indian MSME segment better. One thing that was repeatedly highlighted was the fact that India needs to change its strategies and bring in different solutions for the MSME sector.

Dinesh Agarwal, chief executive officer (CEO) of ecommerce platform IndiaMart, highlighted that almost 80% of the Indian MSMEs have such low turnover that they are not even good and services tax (GST) registered and their needs are going to be really different from the fractional MSMEs with more than ₹50 lakh as revenue.

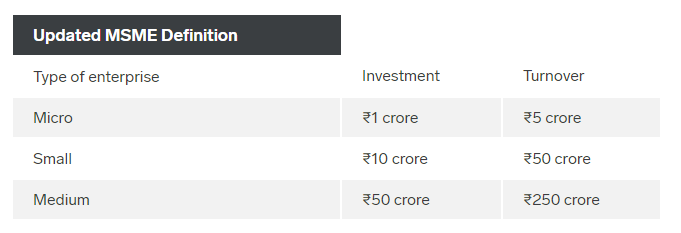

Notably, MSMEs need to have a turnover of at least ₹50 lakh to register for GST. Meanwhile, a company is considered MSME based on its investment and turnover.

He noted that there needs to be a different approach that needs to be taken in order to cater to the needs of each one of them.

Meanwhile, fintech firm BharatPe’s group president Suhail Sameer added that the system also needs to change to stop benefiting large businesses at every step of the way. “People who don’t need credit get all the credit. People who need credit, even though they are willing to pay a higher rate of interest, unfortunately can’t be underwritten,” he said.

He also notes that the banks have to solve for it, as the government has already done its bit by reducing the interest rates on the loans given the MSMEs. He noted that a lot of entrepreneurs start a small business bank because they can’t get a universal one.

“What are you eventually underwriting [a loan] on the back of? If you are underwriting on the back of CIBIL (Credit Information Bureau of India Limited) score, you’re underwriting on the back of five years financial numbers. You’re no different from a universal bank and I don’t necessarily see what you will lend, they can’t lend with a lower cost of capital,” he said, meaning that small finance banks need to set up different criterias to lend to MSMEs.

BharatPe.will soon be taking over Punjab and Maharashtra Cooperative (PMC) bank in a consortium with Centrum. Sameer added that given their history of lending to small merchants over the three years, they understand alternative forms of data to judge these borrowers on.

“Banks would look at the recollection behavior and sort of make a judgment three months out, versus I [BharatPe] can see how the economy is moving based on the transactions and then take some of these judgment calls sooner [compared to banks]. On one side, we’re talking about credit slowing down. On the other side, we [BharatPe] have seen the loans we have helped disburse grow from like ₹15-20 crore a month, just at the beginning of COVID’s first wave (March 2020), to disbursing ₹300 crore a month at the start of COVID wave two (April 2020),” Sameer said.