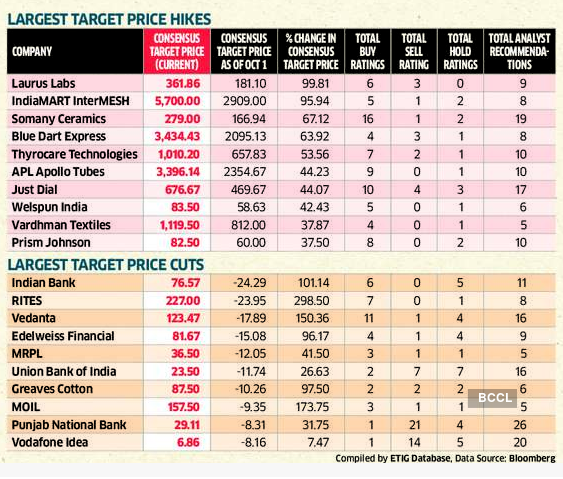

Diagnostic companies, drug makers and information technology companies have seen the biggest increases in stock target prices by analysts after their September quarter results. Banks and public sector companies have seen the biggest target price cuts, according to an analysis of BSE500 companies tracked by at least five analysts. Majority of the target price increases have come on the back of strong earnings growth in the quarter. For instance, the consensus target price for Laurus Labs has increased by 99.8 per cent to Rs 361.86 after the company registered a four-fold jump in consolidated net profit to Rs 242.3 crore in the September quarter.

The consensus target price for IndiaMART NSE -0.24 % InterMESH, Somany Ceramics, Thyrocare Technologies and Wipro has increased by 31-96 per cent. Cyient, Persistent Systems, Coforge, KPIT Technologies, Infosys and TCS increased by 22-28 per cent. “IT companies reported record margins and growth outlookalso improved… Diagnostic companies gained because of Covid-19 testing and their operations were not impacted by the pandemic,” said Abhimanyu Sofat, head of research at IIFL Securities.

“The September quarter earnings season was good as the economy was rebounding and there was stocking ahead of the festive season. The true story of recovery will be known by January,” said Sofat. PSU banks and other public sector units are among those with biggest target price cuts. Indian Bank, Edelweiss Financial Services, Union Bank, Punjab National Bank, NMDC, and BHEL saw their consensus target prices being trimmed by 5-24 per cent.