“It will take some longer period before we can look at that kind of grown [20%] again,” IndiaMART CEO and MD Dinesh Agarwal said during the company’s earnings call for Q4FY20 on May 13. Right now, the company’s aim is to protect its current revenues and customers, and focus on the growth and ARPUs later since the customers are also suffering from a financial crunch, he said. The lockdowns have already affected the company’s ARPUs for Q4FY20 and for April, and will continue to affect them “substantially” in the short run, and in the long run, depending on how the lockdown plays out, he said.

Having said that, Agarwal also said that the company’s geographic and category diversification could help them leverage staggered opening of the lockdown and that the company’s subscription-based model, negative working capital and robust cash reserves made them confident.

- Impact of economic slowdown exacerbated by the lockdown: Last year, the auto sector and real estate were severely affected, followed by financial turmoil, followed by the NBFC crisis that hit the SMEs, and now the pandemic. “The last financial year has been challenging because of the weakness in the overall economy and we have been sharing this information since last 2-3 quarters itself,” Agarwal said.

- Expect sales and collection from customers to remain suppressed for next few months: The company is taking cost optimisation measures such as “relooking at the current cost structure, renegotiating vendor contracts, looking at variable costs, deferment of appraisals and temporary salary rationalization without doing any kind of layoff”, Agarwal said.

- Affect on employees: Agarwal clarified that the company has not planned any layoffs. Only the variable pay has come down since salespeople aren’t able to meet customers, but are engaging with them via phone and online.

‘Customers severely affected by lockdown, hard to predict impact on IndiaMART’

Because of the lockdown, the platform is not adding any new customers, or very few who are coming for particular categories of products, Agarwal said. Last quarter, weak economy had led to lower customer additions than the long-term average of 5,000+ customers per quarter and low market demand. He also said that economic slowdown has reduced market demand and led to cash flow and credit crunches. ARPU growth also dropped from historical trends of 5%-10% to 7% in Q3FY20.

“So given that we have nearly 150 thousand paying subscription suppliers customers and we are not adding any new customers or adding very little number of customers, who maybe specifically coming from the special focus categories that are working in the COVID times, I would say that let us assume that we would be down by 20% from our current customer base if the current and fourth lockdown is the last one. If the uncertainty continues further, and the economy goes through further challenges, I can only come back and tell you in a month’s time or so, about what kind of feelers do we have. As of now I can only tell you that maybe about 10% are already on hold and in the next 45 days, based upon our experience of the last 45 days, another 10% may go.” — Dinesh Agarwal

“[F]or every month of lockdown, we may end up losing 10% of the existing customer base because during lockdown, lot of customers may not be able to afford or may have to change their business model. SO I would say, that assuming that in the next 3 months all of this is over, I may lose 20% of my customer base and as things return to normalcy over 6 months we will start to add maybe 1,000 customers per quarter and then 2,000 and then 5,000 customers in sometime. But we don’t really know how it will pan out in the times to come.” — Dinesh Agarwal

10% to 20% customers ‘severely impacted’, more likely to churn: Since new sales are not possible due to the lockdown, and IndiaMART’s salespeople can’t meet customers as most businesses and premises are completely closed, Agarwal expects 10% to 20% of the subscriber base to be “severely impacted” and are more likely to churn.

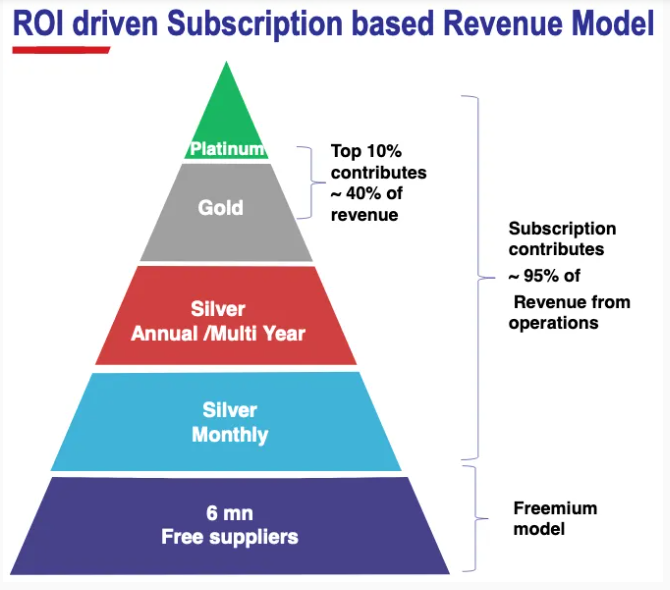

All subscriptions work on a rolling basis, and aren’t affected by the financial year. Agarwal explained their three tiers:

- Platinum tier: 10% of the customers who account for about 40% of IndiaMART’s revenue and 5% to 6% annual churn.

- Gold tier: 30% to 35% of customer base with 10% to 12% annual churn. Both Platinum and Gold tiers are only available as annual or 2 or 3 year subscriptions.

- Silver tier: 33% of customers opt for the Silver monthly tier. Agarwal didn’t give the numbers for Silver annual subscription. These see 20% to 25% annual churn and 5% to 6% monthly churn.

But he acknowledged that it’s hard for people at the top of the pyramid to sustain subscriptions as well because of the costs involved (₹ 1,75,000/year or almost ₹15,000/month) and stress caused by the lockdown. As a result, since March 20, they have received multiple requests to cancel subscriptions, or to give them extensions, or to temporarily suspend their account for a month or a quarter, or to downgrade their account to a lower tier, or . Of the approximately 147,000 customers they have, about 50% have paid for more than a year, Agarwal said.

More than one-third of the customer base is more than 3 years old. Few customers are also more than 15 years old. Customers remain on the platform to make use of the lower subscription rate. For instance, if someone joined in 2014-2015, they paid ₹2,000/month and continue to pay that rate. If they were to churn out and join back in later, they will have to pay ₹3,000/month, D. Agarwal explained. Older customers are also more inclined to upgrade their tiers after experiencing the platform and growthing through it, he said.

Company offers discounts, relaxed payment terms to SME customers: According to Agarwal, the financial crunch started in October-November 2019, and “got further acute when the sudden and long lockdown happened”. To retain customers, it has offered them discounts, shorter duration renewals, relaxed payment terms.

Funding for companies will become tougher in the short- to medium-term; goal should be to consolidate

“[F]unding would become tougher for the short-term to medium term as the funds will chase the best returns in these times and for any new kind of a trial and testing, the funding would be less available,” Agarwal said in response to a question about whether or not competitive intensity would subside as Udaan is facing funding challenges. He, however, pointed out that Udaan already has “a large amount of funds available with them” and because of their financial prudence, had been able to save them for long. “[F]or now, there may be certain opportunities for us to consolidate and as much as we can consolidate, that should be our goal,” Agarwal said.

No competition for the products and services IndiaMART deals into: However, their ability monetise on that immediately will depend on the financial situation of the customer. Agarwal differentiated between IndiaMart, Udaan and Amazon: “We are mostly manufacturers, wholesale traders, custom product made, truck load products. Just to give you one comparison, if Udaan has about $60 average order value, at IndiaMART it would be around $600 and at Amazon it may be at around $16.”

- ‘TradeIndia has been around longer, but we are the leaders’: “Today if we get about 50-60 million visits on our platform every month, as per the public data available on similar web; they get less than 5 million or even 3 to 4 million visits on their platform every month,” Agarwal said.

Funding will be harder for smaller start-ups: He predicted that two years down the line, with increased adoption of internet, “the competition and funding can come back with a far more rigor and far more vengeance, just like when IndiaMART became successful, a large amount of funding went into multiple B2B and SME platforms”.

New avenues of growth: Internet adoption, bigger brands with liquidity, and exports

Internet adoption: “An overall adoption curve of the Internet will improve,” Agarwal predicted. Coupled with a potential increase in “manufacturing intensity” in India in the post-COVID-19 scenario, this could increase IndiaMART’s market size. He expects online and tele-sales to grow and reliance on physical meetings to decrease, thereby making their operations more efficient.

200 bigger brands such as Philips, Tata Steel, etc. which are already using the service would be a good source of revenue, especially given their liquidity. This is why investment into Bizom is helpful since they know how to handle big clients, D. Agarwal said. Currently, IndiaMART’s sales and collections are driven by those who have cash, he said.

Bigger brands add trust to the marketplace, attract more traffic: D. Agarwal pointed out that smaller players are usually regional players while bigger brands, such as Tata Steel or Tata Motors, have a dealer distribution network to work at a national level. “[P]resence of a brand gives a lot more trust to the buyer that the entire list of manufacturers or suppliers is present here and it is not a flea market but a more trusted marketplace,” he said. Bigger brands can fulfil remote buyer enquiries while SMEs fulfil long tail of pricing and products. Thus far, the two kinds of enterprises have not quit on account of the other.

Exports: “In fact there could be a possibility even on the export side if ‘Make in India’ becomes better or truer,” Agarwal said.

‘Open to investments and buyouts, but only in strategic areas’

- ‘IndiaMart only invests in strategic areas’: The company is not averse to buying out and will make investments in spaces that “add on to the ecosystem of small and medium sized businesses,” Agarwal said in response to if they intended to buy out companies in adjacent areas. In September 2019, it had invested in Vyapar, a mobile-based self-accounting software.

- ₹10 crore investment in Bizom: Along with Triton Investment Advisors, the company has invested in Mobisy Technologies Private Limited which run Bizom, a “Bangalore-based SaaS start-up offering sales force automation and distribution management system to medium and large sized businesses”. This will help IndiaMART with distribution and direct retail needs of its customers, especially because they “are taking advantage” of mobile phone/smart mobile computer and majority of IndiaMART’s suppliers use the IndiaMART mobile app, Agarwal said.

Operational numbers

50% reduction in traffic but spikes in categories of essential items: Agarwal said that traffic had reduced “on an average of 50%” but varied “significantly across categories and across geographies”. This is true for traffic, enquiry, calls and versus RFQ (request for quotes). “We are witnessing significant traffic growth in categories such as sanitization, safety, hospital, pharmaceutical and food supplies etc. and in indirect categories like chemical, packaging, raw materials related to the above-mentioned items,” he said but did not give numbers for these spikes. The company is identifying such essential categories and is working to increase the number of suppliers for them across India. Though traffic improved in April, but Agarwal wasn’t sure if he could be “hopeful of sustaining everything like this”.

- Traffic: 180 million, 5% YoY growth from 171 million in Q4FY19 but 4.2% QoQ decline from 188 million in Q3FY20

- Traffic through mobile: 76%

- Total business enquiries: 116 million, 3% YoY growth from 112 million in Q4FY19

- Paying subscription suppliers (subscribers): 147,000, 14% YoY growth from 130,000 in Q4FY19, 3.5% QoQ growth from 142,000 in Q3FY20 (61% of them are in metro cities and 26% in Tier II cities — population > 500,000), net addition of 5,000 suppliers in the quarter

- Non-subscription suppliers: 6 million

- Supplier storefronts: 6 million, 8% YoY growth from Q4FY19 (35% of them are buyers)

- Product listings: 67 million in more than 100,000 categories

- Registered buyers: 102 million, 24% YoY growth from 83 million in Q4FY19, 4% QoQ growth from 98 million in Q3FY20 (55% are repeat buyers, 35% buyers are in metro cities and 26% in Tier II cities)

- Customer Relationship Management (CRM) data for Q3:

- Number of call backs and replies: 40 million calls and messages by about 100,000 businesses

Financial numbers

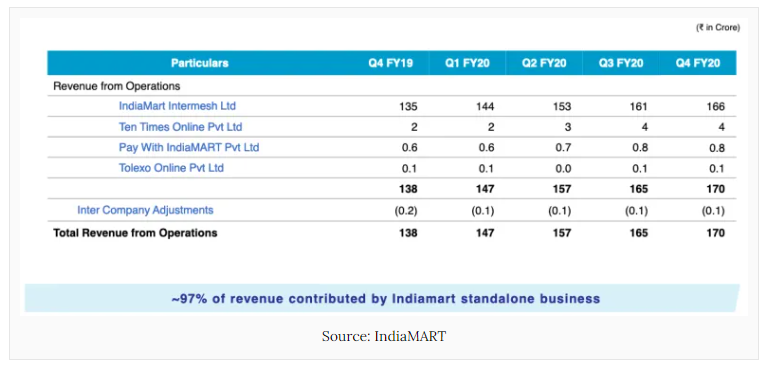

- Revenue: ₹170 crore, 3% QoQ growth from ₹ 165 crore in Q3FY20, 23% YoY growth from ₹138 crore in Q4FY19

- Revenue for FY20: ₹639 crore, 26% YoY growth from ₹507 crore in FY19

- Collections from customers: ₹206 crore, 12% QoQ growth from ₹184 crore in Q3FY20, 1% YoY decline from ₹208 crore in Q4FY19

- Collections from customers for FY20: ₹738 crore, 10% YoY growth from ₹671 crore in FY19

- Net profit: ₹44 crore (24% margin), 29% decline from ₹62 crore (34% margin) in Q3FY19, 57% YoY growth from ₹28 crore (18% margin) in Q4FY19

- Net profit for FY20: ₹ 147 crore (21% margin), 635% growth from ₹20 crore in FY19

- Average ARPU: ₹45,000/year, 8% YoY growth from ₹ 41,700/year in Q4FY19, 0.7% QoQ decline from ₹45,300/year in Q3FY20

- Approximately 97% of revenue came from the IndiaMart standalone business. A more detailed distribution of revenue from operations of its payment (Pay with IndiaMART) and business management (Pooraa) businesses is given below: